Asset Management – Compliance & ESG | SFDR 2.0: From paper exercise to impact?

A proposal for a revised SFDR is expected in late 2025, likely introducing a new fund classification framework and more stringent criteria for what qualifies as sustainable. In this newsletter, we examine the recommendations from the European and Norwegian regulators for an SFDR 2.0 and offer our guidance for Norwegian asset managers.

Background

The SFDR has, in many ways, turned into a paper exercise. Some of the challenges with the current regulation stems from the ‘fund categories’ (Articles 6, 8 and 9), which have not worked as intended: Article 8 is overly broad, and captures products with minimal sustainability ambitions, while Article 9 is viewed as a label for sustainable funds (even though underlying holdings may not support such a designation). Additionally, the SFDR’s concept of sustainable investments is vague, leading to inconsistent interpretations.

To address these shortcomings, the European Supervisory Authorities (ESAs) have recommended fundamental changes to the SFDR. If these recommendations are implemented, they could lead to a regulatory framework with a stronger focus on substance, backed by clearer and stricter criteria.

New product categories and labels

Articles 6, 8 and 9 determine disclosure and reporting obligations for financial products, and do not necessarily reflect the sustainability performance of the underlying portfolio. Nevertheless, they are often misconstrued as indicative of actual sustainability performance. Therefore, the ESAs recommend moving away from Articles 6, 8 and 9 and introducing fund categories that more clearly convey a product’s sustainability ambitions. The ESAs propose introducing four new fund categories

The ESAs further recommend tailoring disclosure and reporting obligations to each of the four categories described in figure 1. For example, they recommend that products in the ‘sustainable’ category should be required to mitigate the principal adverse impacts (PAI) of investment decisions, while products in the ‘transition’ category would only be required to disclose information about those impacts.

Stricter requirements for sustainable investments

Currently, the SFDR outlines three general requirements that must be satisfied for an investment to be deemed sustainable, as set out in figure 2. However, there is limited guidance on how these three requirements should be interpreted. The ESAs recommend more prescriptive rules, such as thresholds for determining when an activity contributes to an environmental or social objective.

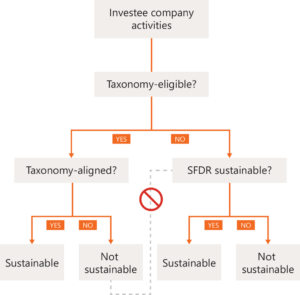

Importantly, the ESAs also recommend clarifying that investments in activities that are taxonomy-eligible, but not aligned (that is, they do not meet all taxonomy criteria) should not be assessed against the SFDR’s definition of sustainable investment, as illustrated in figure 3.

In the long term, the SFDR’s definition of sustainable investments might be replaced by the taxonomy. The European Commission anticipates a more comprehensive taxonomy covering all environmental objectives, transition activities, harmful activities, and socially sustainable activities, thereby removing the need for SFDR’s definition.

Feedback from the Financial Supervisory Authority of Norway

The Financial Supervisory Authority of Norway (FSAN) provided its feedback on a revised SFDR on 26 May 2025, proposing three changes not linked to the reforms mentioned above:

- Removing sustainability risk from the SFDR (Articles 3 and 6), arguing that the obligation to assess sustainability risk follows from sectoral legislation. While we agree with aligning SFDR to sectoral legislation, we note that the FSAN did not address how this change might affect registered AIFMs that are not subject to those provisions.

- Removing the disclosure requirements at entity level (Articles 3, 4 and 5). We support this proposal, given the limited value these disclosures provide to relevant stakeholders.

- Aligning the requirements concerning the consideration of principal adverse impacts (PAI) at product and manager level (Articles 4 and 7). We agree that further clarification is needed on this point.

BAHR comments

An SFDR 2.0 in line with the ESAs recommendations would establish a framework more focused on substance, backed by clearer definitions. Although the final text depends on the European Commission and the co-legislators, asset managers should be mindful of these possible changes. While new rules typically do not apply retroactively, it is worth noting that the original SFDR did apply to funds that were no longer marketed. As such, (parts of) SFDR 2.0 may apply to funds that are closed when the new rules enter into force.

We recommend that Norwegian asset managers consider the following points:

- Factor potential changes into fund documentation and marketing material for new products and consider to explicitly address how such changes will be managed.

- Be cautious with incorporating detailed SFDR requirements in fund mandates (e.g. spelling out and linking mandate to SFDR’s definition of sustainable investment in fund agreements) as these regulatory terms and definitions may change or be phased out during the product’s term.

- For funds that commit to make (a proportion of) sustainable investments: assess how stricter requirements for what qualifies as sustainable and a potential phase-out of SFDR’s definition could affect such commitments. Ensure that fund documents offer the necessary flexibility vis-à-vis investors.

- For new products, consider whether the strategy might meet future thresholds for sustainable or transition product categories.

- Communicate early with investors on how regulatory changes may affect a product’s classification at fund and portfolio level and clarify how these changes will be addressed.