Asset Management | From Green to Genuine: Will you need to rename your funds to comply with ESMA’s new guidelines?

Scope and Application

The new guidelines apply to managers of Alternative Investment Funds (AIFs) and management companies of Undertakings for Collective Investment in Transferable Securities (UCITS). The guidelines do not explicitly address their applicability to non-EEA alternative investment managers marketing either EEA-AIFs or non-EEA AIFs within the EEA. The broad wording and inherent connection to marketing rules suggest that the guidelines apply to alternative investment fund managers marketing AIFs in the EEA regardless of their home state.

Managers of any new funds created after 21 November 2024 must apply these guidelines from the outset. Managers of existing funds have until 21 May 2025 to ensure compliance. The Financial Supervisory Authority of Norway (FSAN) has announced that it will enforce these guidelines accordingly.

Key Compliance Requirements

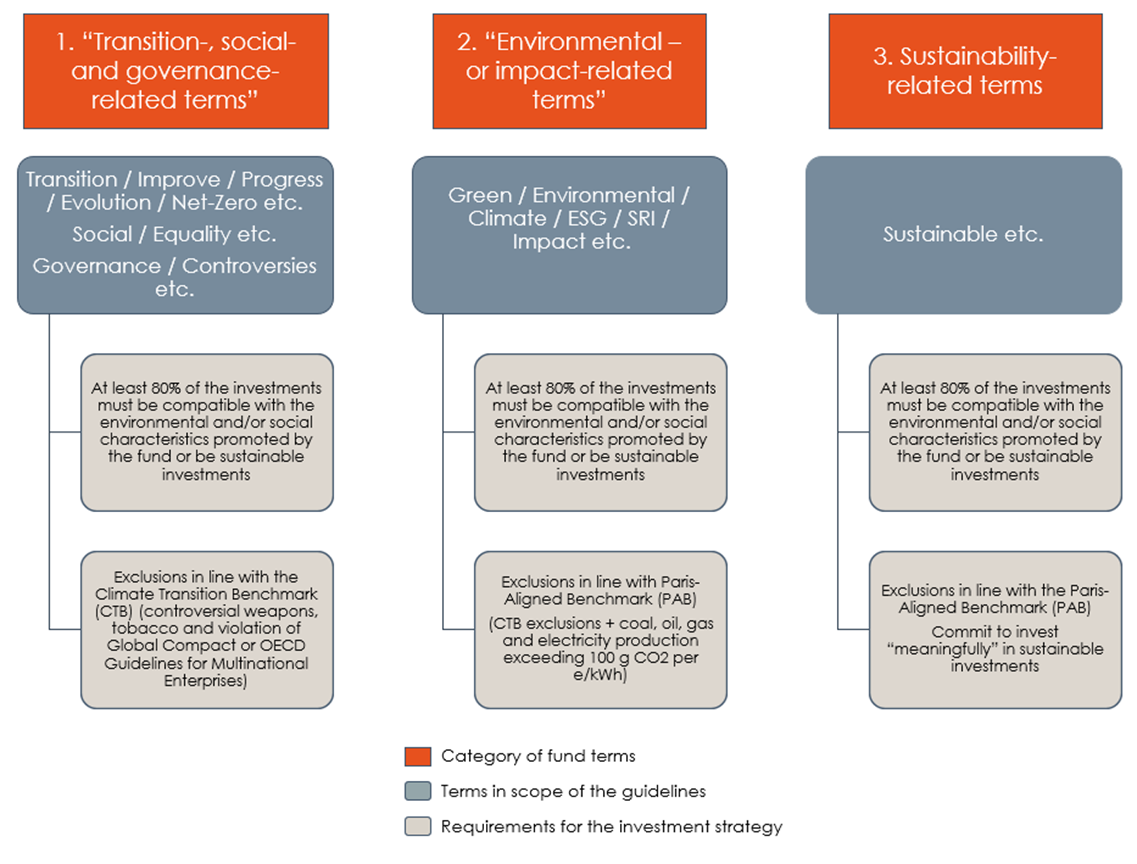

The guidelines distinguish between three categories of terms and corresponding requirements for the investment strategy, which we have summarized in the chart below. We have included the terms explicitly mentioned in the guidelines as being within scope. The examples listed in the guidelines (and referenced in the chart below) are non-exhaustive. Funds using one of these terms will have to assess whether they fulfill the requirements for the investment strategy.

If a fund name combines multiple terms from categories 1 and 2, the requirements of those categories apply cumulatively. However, for combinations involving transition-related terms, only the requirements in category 1 shall apply.

Funds using “transition-” or “impact”-related terms in their names should also ensure that investments used to meet the threshold referred to in points 1 and 2 respectively are on a clear and measurable path to social or environmental transition or are made with the objective to generate a positive and measurable social or environmental impact alongside a financial return.

The guidelines do not prescribe an exhaustive list of terms within their scope. Consequently, the applicability of the guidelines for each fund name must be assessed on a case-by-case basis, taking into account the specifics and usage of the terms.

BAHR Comments

For asset managers, the initial step is to determine whether any funds under management fall within the scope of the guidelines. BAHR has conducted a review of all names of AIFs and UCITS currently registered for marketing in Norway, either licensed by the FSAN or operating on a cross-border basis. Our findings indicate that approximately 90 AIFs (7% of the AIFs in the FSAN registry) and 260 UCITS (23% of the UCITS in the FSAN registry) have fund names containing terms that fall within the scope of the new guidelines.

For funds using any of the terms explicitly mentioned in the guidelines, determining the applicable requirements should be straightforward. Managers of these funds need to assess whether the funds’ investment strategies meet the requirements for the relevant fund name category. Fund names not explicitly mentioned in the guidelines but potentially using related terms must be assessed on a case-by-case basis.

For managers currently in a fundraising process where the fund has not yet been established (e.g. a private equity fund), the guidelines will apply from 21 November 2024. Managers should ensure that the fund strategy aligns with the fund name before the first closing to ensure compliance and to avoid having to make subsequent changes.

For managers of existing funds that fall within the scope of the guidelines and where the investment strategy does not meet the specified requirements, managers must either rename the fund or alter the investment strategy. Beyond commercial considerations, both alternatives involve a review and potential modification of a fund’s foundational documents, marketing materials, and regulatory notifications. Additionally, investor participation and potentially, approval, may be required.