Compliance & Risk Management | Mandatory registration of beneficial owners – the Norwegian UBO registry opens 1 October 2024

A phase-in period of 10 months has been granted, and entities are required to register their beneficial owners within 31 July 2025.

The Norwegian Act on Beneficial Owners (the “UBO Act”) was enacted in 2019 (Nw.: Lov om register over reelle rettighetshavere). Parts of the Regulation entered into force 1 November 2021, but the establishment of the registry has been postponed several times due to various reasons. The duty to establish a national registry is set out in EU’s fourth anti-money-laundering directive, and the purpose is to provide access to information about entities’ beneficial owners.

What are the main obligations of the UBO Act?

The obligations of the UBO Act can be summarized to three main duties:

- identify whether there are UBOs and who those are

- obtain the required documentation forming the basis for the UBO analysis and archive it internally; and

- submit/register the UBO information to the registry.

The duties set out in section (i) and (ii) have been in force since 1 November 2021.

The entities are required to update for any changes in ownership or control and to ensure registration of new UBOs within 14 days.

Does my company need to register its beneficial owners?

The short answer is yes. The main rule is that all legal entities and other associations (including trustees of foreign trusts and similar) that conduct business in or are registered in Norway, are required to register their UBOs and comply with the other obligations of the UBO Act.

There are certain exceptions, including:

- Public companies are exempt from the duties to identify and register UBOs and shall register information about the stock exchange or marketplace where their shares are listed instead, as further specified in the UBO Regulation. The exemption applies to entities with shares listed on a regulated market (in Norway, the Oslo Stock Exchange and Euronext Expand) in an EEA state or other state with equivalent ownership transparency rules. The exemption does however not apply to their subsidiaries, meaning that the exemption is of limited significance for listed ultimate parents in large group structures.

- Norwegian branches of a foreign company (NUFs) are also exempt from the duty to register UBOs in the Norwegian register, under certain conditions.

- Certain other entities and associations are covered by a general exemption from the UBO Act, including bankruptcy estates, state-owned enterprises, securities funds established under the Securities Funds Act, etc.

Who is a beneficial owner under the UBO Act?

The UBO Act defines any natural person who meets one or more of the following criteria as beneficial owner:

- owning more than 25% of a company

- controlling more than 25% of voting rights in the company

- having the right to appoint or dismiss more than half of the board members of the company

- exercising influence and/or control in other ways.

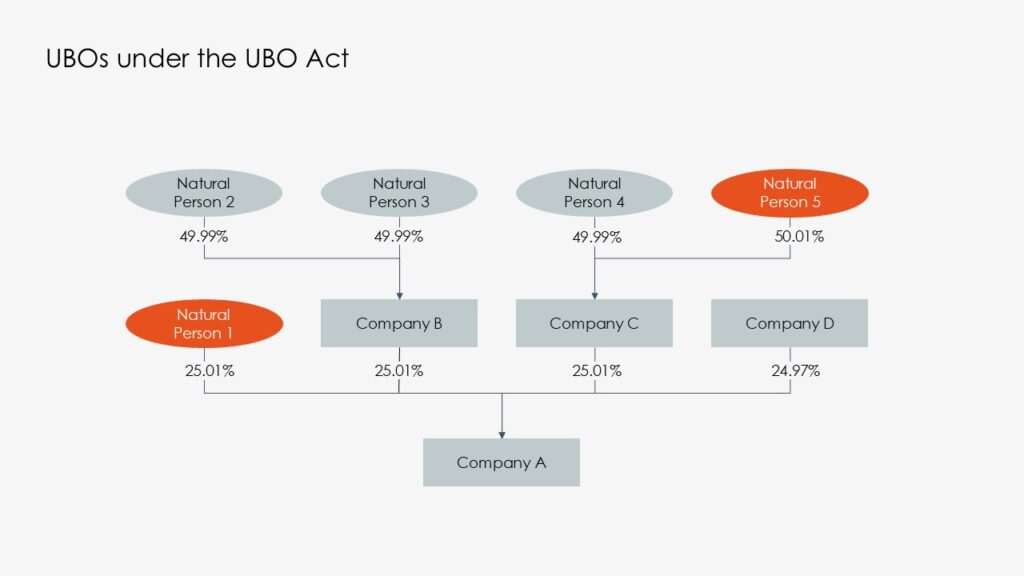

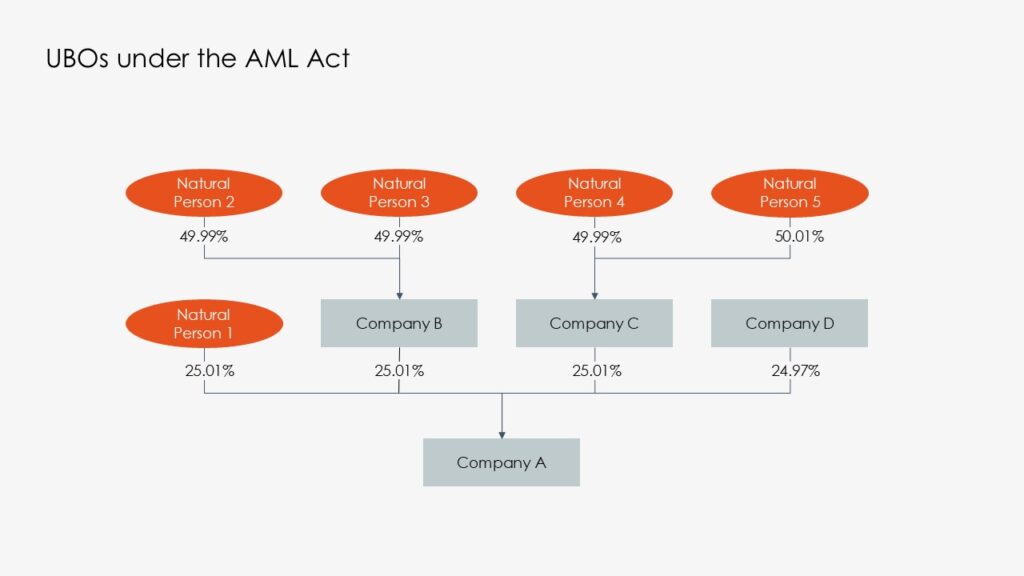

The definition is similar but not identical to the definition under the Norwegian Anti-Money Laundering Act (Nw.: Lov om tiltak mot hvitvasking og terrorfinansiering). The latter generally applies a mechanical approach which typically results in a large number of beneficial owners being identified. That approach is significantly modified under the UBO Act.

Under the UBO Act, beneficial ownership can be established on a direct or indirect basis. The method for establishing relevant ownership or control is set out in the appurtenant Regulation. It should be noted that although the general provision in the UBO Act explicitly states that the UBO identification shall be performed in accordance with the criteria set out in the Norwegian Anti-Money Laundering Act, the actual criteria set forth in the Regulations yield significantly different results.

Two practical examples – and differences, compared to the Norwegian Anti-Money Laundering Act – are the rules on direct and indirect beneficial ownership through ownership of shares:

- Direct beneficial ownership is established where a natural person is the owner of 25.01% of the shares in company A.

- Indirect beneficial ownership is established where a natural person owns 50.01% of each intermediary from the top of a structure and down to company B, where company B holds 25.01% of the shares of company A.

Where can I find information on who is the beneficial owner of a company?

To establish whether natural persons are beneficial owners through indirect ownership or control may require a detailed analysis, especially if the corporate structure of the company is complex.

The company is required to assess the ownership of shares through the company structure, and to determine whether there are any agreements (formal or informal), articles of association or other instruments that establish control rights in any other way than through the legal ownership to the shares.

Provided that other means of ownership and control are ruled out and the only way to exercise control of company A is through the ordinary rights that follow the legal ownership to the shares, the shareholder registers of each company in the structure will provide adequate documentation to establish the ownership and control rights to the top of the structure.

The company is required to store all information and documentation forming the basis for the UBO analysis internally. The assessment shall be verifiable, and the company is obliged to disclose the documentation to the authorities upon request. This applies regardless of whether there are identified UBOs, or if the conclusion after the assessment is that no natural person fulfils the criteria.

What information needs to be submitted?

Once the beneficial owner(s) are identified, the following information must be registered: full name, national identity number or D number (or date of birth if unavailable), country of residence, and all citizenships. How the beneficial ownership is established (directly or indirectly), through ownership or voting rights etc., and the relevant intervals (for example 25.01-49.99%) shall also be registered.

If the company concludes that there are no natural persons that meet the criteria to be considered a beneficial owner, this shall be registered, along with the details on the company’s pseudo-UBOs which are the board of directors and CEO.

How to prepare for the reporting and general recommendations:

- Start early: We recommend starting the preparations as soon as possible. It may take time to get an overview, to collect information from relevant intermediaries and to identify or rule out possible forms of control.

- Be thorough and document your assessments: If the analysis is through and solid, it will probably be less challenging to keep the assessment and documentation up to date.

- Implement procedures: Entities are required to register new UBOs within 14 days and should implement internal procedures for monitoring of changes in ownership or control in the structure.

- Coordinate throughout group structures: Group companies should coordinate their assessments and consider designating specific resources or group entities to manage this responsibility to avoid duplication of effort and assessments based on outdated or inaccurate information. A way to set this up is to make the parent company responsible for collecting information and updating the assessments and to distribute necessary information and documentation to the subsidiaries as appropriate.

- Note that the UBO Act is different from the Anti-Money Laundering Act: Many companies have prepared ownership and control assessments for other purposes, such as in relation to KYC requests from banks or in procurement or tender processes. Structure charts and other information may be useful as basis for the UBO assessment, but should be carefully reviewed against this particular UBO definition as it may differ from other UBO definitions, including the UBO definition in the Anti-Money Laundering Act which is the definition that the banks and certain other entities must apply in their KYC assessments.

- Keep a file of relevant documentation at hand: The UBO Act sets out detailed requirements to the documentation that needs to be collected and stored internally to form the basis for the UBO assessment. The companies should ensure that all relevant information assessed and collected, and in particular that less transparent forms of control such as private agreements are identified.

Access to the registry

Today, 3 September, the Norwegian Ministry of Finance submitted for consultation a proposal regarding access rights to the UBO registry. These changes are mainly adjustments and proposals on the practical implementation of amendments passed in June 2024 on granting access to selected public authorities, entities subject to the AML Act, media, civil society organizations, and higher education institutions. Certain additional changes were also proposed, including the implementation of the EU Regulation 2021/369 on the interconnection of beneficial ownership registers in the EEA. Comments on the proposals are requested by September 24, 2024.

***

Should you have any questions or require assistance in identifying your company’s beneficial owners, please do not hesitate to contact us. Our team is ready to support you in the preparation and submission of the required information in an adequate and timely manner.