Offshore wind update: Utsira Nord competition re-launched and revised competition rules published

In this newsletter we share the key take-aways from the published competition documents by the Ministry, expanding on our previous newsletter summarizing the key elements from ESA’s decision from 15 April 2025 approving the support model for Utsira Nord.

The deadline for submitting applications is 15 September 2025.

For further insights, reference is made to our breakfast seminar on 4 June 2025 at 08:30 -10:00 CET.

The Competition Model

Summary of the Utsira Nord offshore wind competition

The Utsira Nord offshore wind area is located west of Haugesund just outside of the Utsira island and is due to its average water dept of 265 meters only suitable for floating offshore wind technology. Three project areas of 182 km2 each will be awarded, each with a maximum permitted installed capacity of 500 MW. The capacity density shall at a minimum be 3,5 MW/km2 and the buffer zone is 5 km between each project area.

The projects awarded area rights will, provided the successful developers mature their projects in line with the criteria (and no changes are being made to the support scheme in the interim period), be able to compete for the aid of 35 billion NOK maximum (inflation adjusted up to COD) by way of investment support (in contrast with the 2023 announcement where the support was proposed to take the form of a CfD) after approximately two years from award of area rights.

Only one of the three projects will be awarded state aid in the subsequent competition for state support (compared to the 2023 announcement where two out of three were to receive state aid in the subsequent competition for state support).

The stated purpose of the two-step model is to ensure that projects are matured to a sufficient level at the time for state aid competition, thereby increasing cost certainty for the developers and reducing risk premiums with end result being to minimize the level of needed state support.

The competition rules for area rights and key differences to the 2023 documents

The competition for area rights will – in line with the approach suggested also in 2023 – be based on qualitative criteria. There will not be a prior pre-qualification process like in the Sørlige Nordsjø II competition. Key change from the 2023 competition document is that several of the criteria that was part of the qualitative criteria have now been categorized as eligibility criteria, which are minimum criteria the participants will have to fulfill in order to be eligible to compete based on the qualitative criteria.

The conditions for participating in the subsequent state aid auction

A prerequisite for the state aid auction is that at least two of the three developers have applied for a production license under the Offshore Energy Act and the Energy Act and completed other formalities necessary to participate in the auction, such as providing the required bid guarantees. In order for the developers to be able to submit an application for production license, the developers would have to carry out a project-specific impact assessment according to the Offshore Energy Act and the Energy Act and have sufficiently matured the projects in order to be ready to submit the license applications. This also means that the developers are dependent on at least one of the other two developers continuing their projects in line with the indicated timeline i.e. whether or not the state aid auction will be held is outside the respective developer’s sole control. In the announced document, the Ministry indicates that they intend to hold the auction as soon as at least two of the consortiums have submitted their license applications, with a minimum two months prior notice.

The Eligibility Criteria

The eligibility criteria consist of the following:

- Minimum revenue requirement: Aggregate revenue exceeding NOK 20 billion the last three years. For consortiums, this revenue criteria will be counted on an aggregate basis, however so that when counting the respective consortium members share, it will be adjusted based on its ownership in the consortium. In the 2023 tender rules, the revenue requirement was NOK 30 billion, and the previous hard requirement for each consortium member has now been relaxed.

- Minimum solidity: Applicants has to have a solidity of at least 20% or be credit rated with at least BBB- (S&P) / BBB- (Fitch) / Baa3 (Moody’s) / BBB. While the revenue requirement applies on an aggregate basis, the solidity requirement applies to each consortium member.

- Financing plan: The developers will have to have a realistic plan for how the project will be financed (debt and equity) with allocation of pre-FID costs and full project costs up until COD.

- Relevant experience: Having at least carried out the development, construction and operation of a 200 MW offshore wind farm (or larger wind farm) and having experience with the development, construction and operation of at least a 66 KV grid connection.

- Project plan: Comprising the key milestones, including the activities for license applications under the Offshore Energy Act and the Energy Act, timing for securing long-lead items and capacity reservation agreements, FID, installation work and COD. The Ministry indicates the developers shall assume 4 months for the Ministry’s determination of the project specific impact assessment program, 6 months for handling the license application and 6 months for handling the detailed plan (however the Ministry has made it clear that these are indicative estimates and does not in any way bind the Ministry to relevant processing times).

- HSE: Satisfactory systems in place ensuring quality assurance HSE and control.

- Integrity: Compliance with tax obligations, not on sanctions list, convicted of corruption, fraud, money-laundering and other KYC requirements.

- Climate footprint: Carried out relevant climate footprint calculations in line with ISO 14040 and 14044.

- Recyclable material: Estimates of the share of the aggregate material applied in the project that are recyclable, specified for the nacelle, blades, tower, floaters and anchoring solutions, inter array cables and the grid connection respectively.

- In order to meet the relevant criteria, the consortiums can rely on support from relevant associated companies of the consortium member, provided that such relevant entity(ies) has issued the support letter on the prescribed format.

The Qualitative Criteria

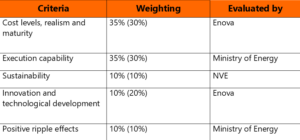

The developers will be scored on a scale from 1-10 on five main qualitative criteria. The developer with the highest score will have the right to select its preferred project area first. Their relative weighting are as follows:

The percentages in parenthesis are the weighting as ws given to the relevant criteria in the 2023 announcement and consequently as can be seen, more weight is now allocated to the cost levels and execution capability whilst the weight on the innovation and technological development criteria is reduced.

Each qualitative criteria includes a more detailed explanation and documentation requirements.

Below is a high-level overview of the main content of the criteria:

- Cost levels, realism and maturity: Developers will be ranked on cost estimates for developing a 500 MW floating offshore wind project at Utsira Nord as established and fully operational by 2034 (compared with the 2023 announcement where the target date for COD was 2030). This criteria will be evaluated by Enova, since it has extensive experience in assessing cost estimates for immature technologies, including floating offshore wind projects.The assessment of the criteria is subdivided into seven distinct sub-criteria, where the numerical cost estimates will only play a minor part. The predominant weight will be based on the following documentation provided by the developer:

- on the methodology employed in the development and estimation of the cost projections;

- on delineating the maturation and qualification of the technology;

- on the processes and dialogue with main suppliers;

- on calculations of annual energy production;

- on the computation of operation and maintenance cost;

- on the execution of uncertainty analysis and the strategy for risk management; and

- on the developer’s experience and competence in achieving historical cost reductions in relevant fields.While lower cost estimates will be weighted positively, most weight will be placed on the maturity, realism, strategies, and processes culminating in the final estimates. Unrealistic, immature and/or unsubstantiated cost estimates will give a lower score to mitigate risks of the developers presenting overly optimistic cost estimates.

- Execution capability: Developers must demonstrate that they have sufficient financial resources, technical competence, and experience to carry out the project within a timeframe and cost estimates. to the rationale for the criteria is to ensure that the most realistic and cost-efficient project is chosen. Developers will also have to submit information on reference projects, plans for financing and project plans. This criteria will be assessed by the Ministry, and comes in addition to the pass/fail eligibility criteria as described above.

- Sustainability: This criteria aims to ensure the environmentally friendly development of the floating offshore wind farms. The developers are being asked to provide aa plan for coexistence and their plans for minimising impacts on climate and environment. NVE will be responsible for evaluating this criteria.

- Innovation and technological development: This criteria comprises the potential for cost reductions from 2034 to 2040 and the dissemination potential. For this criteria, the developers should substantiate how the project concepts have potential for further cost reductions, by quantifying the cost reduction potential of the reference project in completion by 2034 for a repeated project with COD in 2040. Also, the dissemination potential is assessed. Enova will be tasked with assessing this criteria.

- Positive ripple effect: In this criteria, the developers are scored on the degree of the project’s contribution to build experience and developing expertise in the supply chains for future projects. In contrast to the originally proposed criteria in 2023, this criteria does not any longer include any location-specific requirements. Furthermore, the applicant must describe measures that will help ensure smaller businesses gain experience in delivering goods and services to offshore wind, and explain how the project will enhance skills and knowledge within their own organization. The Ministry will assess this criteria.Following award of area rights, each project must submit its project-specific impact assessment program for approval to the NVE within 6 weeks (same as was the case for the SN II project). Thereafter the program will be sent on public consultation and subsequently, based on the comments received, the NVE will determine the project-specific impact assessment program which the developers will have to carry out in order to be able to submit the license applications.

The Support Mechanism – Investment Support

Following completion of the project-specific impact assessments and submission of the license application under the Offshore Energy Act and the Energy Act, the relevant consortium that have been awarded area rights will be eligible to compete in the auction for state support.

The auction will be based on aid per MW for a project of approximately 500 MW and the developers will be ranked based on their required aid amount in proportion to the stated capacity of the project, i.e. the competition for state support among the three consortiums will be a pure monetary price competition. The project with the lowest bid in aid/MW will win the competition for state support and will enter into the aid agreement with the Ministry. The Ministry stated that the draft aid agreement will be published shortly. It is to note that in the announcement documents, the Ministry reserves right to make changes to the support terms up until the point in time when the state aid auction is held.

First-price sealed bid auction

In contrast to the recent auction for the contract for difference for Sørlige Nordsjø II phase 1, where the auction was structured as an open auction with descending bids (i.e. an English auction), the auction for Utsira Nord will be a first-price, sealed bid auction, meaning that the bidders will only be able to submit one bid for support and the lowest bid wins thereby, incentivizing the bidders to submit their best and final offer right from the start.

The minimum size of the project

The maximum capacity of the project is 500 MW, and the minimum permitted capacity will be slightly below 500 MW (taking into account relevant turbine size).. In the consultation for the support scheme for Utsira Nord, it has been debated whether the NOK 35 billion (2025 kroner) budget allocation will be sufficient to attract enough interest from the market given the current costs in developing a 500 MW floating offshore wind project, especially when taking into account the support level comparable floating offshore wind projects outside of Norway benefits from. A solution that has been considered is to lower the project capacity while keeping the NOK 35 billion allocation, however based on these statements this is not a viable option, as bids that fall outside of the stated capacity range will not be considered, and if no bids are received within the specified capacity range, the auction will have no winner and no aid will be awarded.

Support payment profile

In the ESA decision it was stated that a “substantial part” of the total aid will only be paid after the project is completed indicating that the support will not commensurate with the time of the project’s capital expenditures.

However, in the competition documents that were published by the Ministry of Energy 19 May it is explicitly stated that all support will be paid out as a single lump sum at the time of completion of the wind farm. According to the description of the support mechanism and competition for state aid in the competition documents, the project is deemed completed when the majority of the project’s total capacity is operational, and the Ministry of Energy has received confirmation from an independent third party that both the production facility and the grid infrastructure are in operation, and that the facility has supplied electricity at the onshore connection point. Several stakeholders have already argued that a pay-out only at completion significantly reduces the NPV of the support and are exploring possibilities for this to be adjusted, however it remains to be seen whether there will be any changes in this regard.

Clawback mechanism in the operations phase

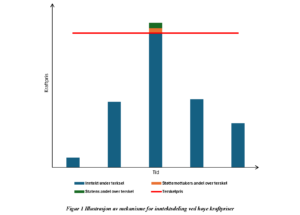

Recently, the Ministry carried out a “mini-consultation” on the potential design of a clawback mechanism to ensure that the winning bidder is not overcompensated. Both the ESA decision and the Ministry’s competition documents confirmed that a clawback mechanism will be implemented. The clawback mechanism will be linked to future electricity prices and take effect in the event of unexpectedly high electricity prices, and corresponding revenues, over a longer period.

In the ESA decision (which for the time being is the most informative document available for the clawback mechanism pending the Ministry’s publication of the state aid agreement), it is stated that the clawback mechanism will be based on the following main parameters:

- Income distribution: In the event of extraordinarily high electricity prices, and correspondingly high earnings for the beneficiary, there should be an income distribution between the State and the beneficiary. The distribution principle is set out under ‘Distribution key’ below.

- Threshold price: The threshold price determines when a share of the income from electricity sales should accrue to the State. The Ministry will set this threshold in advance of the Auction. The threshold price is intended to reflect the level where the electricity prices have become extraordinarily high. The Ministry will use NVE’s latest high estimates when setting the threshold price and add 25%. The Norwegian authorities explain that the threshold price is meant to reflect extraordinarily high electricity prices, therefore 25% is added to NVE’s latest high estimate for NO2. According to the Norwegian authorities, adding 25% to NVEs high price estimate addresses the need to curb extraordinarily high electricity prices, while maintaining a balance between the potential upside and downside price risks for the beneficiary. The threshold price will also be adjusted for inflation.

- Reference price: The reference price will be calculated as an annual production-weighted average. This will ensure that the calculation to a larger degree reflects actual income.

- Distribution key: The distribution key will be 50/50, therefore 50% of the income above the threshold price will accrue to the State.

- Calculation of payment: The income above the threshold price will be calculated annually by determining the difference between the threshold price and the reference price, and multiplying this with the volume sold to spot price. 50% of the income would then be paid from the developer to the State.

- Duration: The clawback mechanism will apply for 15 years from the date of commissioning of the wind farm.

In the Ministry’s consultation on the clawback mechanism, several of the consortiums argued that the volumes sold under fixed price power purchase agreements to Norwegian industry should be carved-out from the clawback mechanism in order not to prejudice the commercial viability of entering into long term PPAs. The Ministry confirms that volumes sold under fixed price PPAs indeed will be carved out from the clawback basis and that the responses from the developers in this respect were adhered to. In light of the structure it can be expected that the winning consortiums will seek to enter into PPAs with offtakers before the auction on state support.

Way Forward

The deadline for submitting applications is 15 September 2025 (a week after the Parliamentary election), and the allocation of project areas is tentatively scheduled to occur in the first half of 2026. Next week, on 25 May, the Ministry opens its Q&A process where participants can submit questions to the Ministry.

Further details can be found in the competition announcement published by the Ministry on 19 May 2025, and further insights gained by reaching out to your offshore wind contact at BAHR.