Private Equity and Asset Management | Brexit: The end of the transition period is approaching

Separate agreement between the EFTA countries and the UK

The EEA EFTA states (Norway, Iceland and Lichtenstein) and the UK have signed a withdrawal agreement dealing with Brexit. The preamble to the agreement states that the rights and obligations under the EEA Agreement should continue to apply to the UK for the duration of the transition period (as set out in the Withdrawal Agreement) and that the parties shall put in place any necessary arrangements for such continuation.

Norway passed a transition act (Act no. 8 of 29 March 2019 on a transition period upon UK’s withdrawal from the European Union) to address the transition period. This act, which came into force on 1 February 2020, states that the UK shall be regarded as an EU member for all legal purposes in Norway during the transition period, which is defined as the period from the day the UK leaves the Union (i.e. 31 January) until Exit Day.

What happens next?

Funds and fund managers

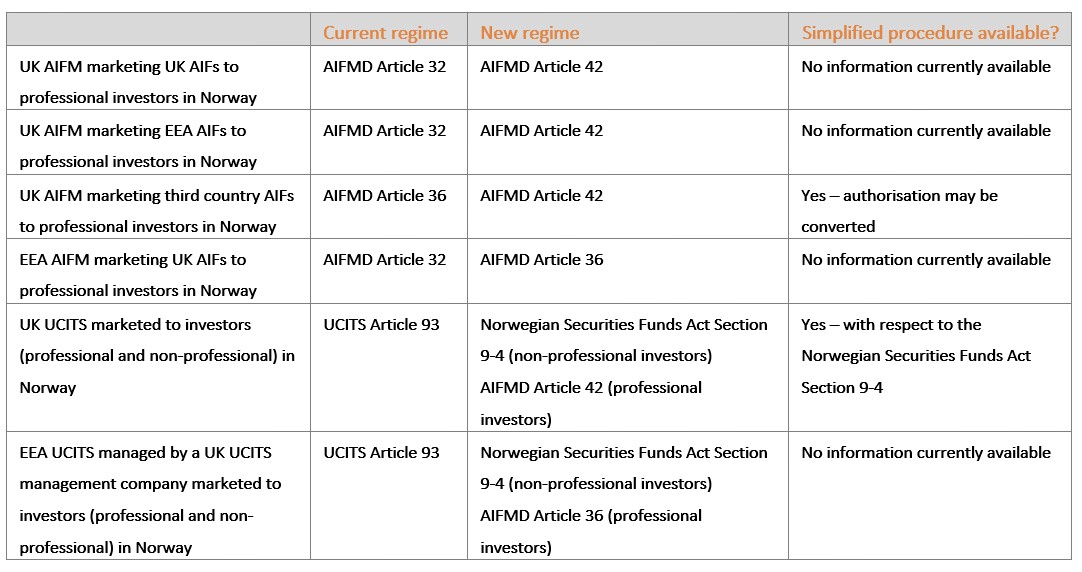

On Exit Day, the UK will be regarded as a third country. Managers based in third countries are not eligible for the passporting regimes set out in the UCITS Directive or the AIFMD. On 4 April 2019, the Norwegian regulator (FSAN), made public a statement regarding the shift in the regulatory landscape that this will cause. The shift can be summarised as shown in the above picture

The FSAN has stated that it will not start processing applications until it is certain that the UK leaves the EU without a relevant trade deal. We expect the FSAN to issue information about a planned process for this shortly. The process will need to give fund managers time to prepare and submit the necessary applications to secure continuity for funds that are currently being marketed into Norway.

A temporary regulation which allows UK MiFID firms (but not insurance companies and credit institutions) to continue providing cross-border services to per se professional clients in Norway after Brexit is already in place. As long as the transition act mentioned above remains in place, the temporary regulation does not really add anything in terms of UK MiFID firms’ rights to conduct business in Norway.

The million-dollar question is what happens to this regulation on Exit Day, but unfortunately it seems no decision has been made regarding that. Our best guess would be that the temporary regulation is kept in place for a short period of time in which firms can apply for the necessary authorisations in Norway.

UK insurance companies

The Norwegian Ministry of Finance has adopted temporary licensing relief for UK insurance companies that were passported for providing services in Norway (on a cross border basis, or through a branch) on the day the UK left the EU. The regulation entails that such insurance companies may continue servicing policies underwritten at that time without permission from the local regulator. Policies covering mandatory insurances that have been underwritten by a UK insurance company shall be considered as underwritten by an EU insurance company until the termination of the policy or as subsequently decided by the Ministry of Finance.

The temporary licensing relief will most likely not have any effect at Exit Day, as it was designed for a no-deal Brexit on 31 January 2020. It remains to be seen if Norwegian authorities will provide additional transitional rules for UK insurance companies.

UK credit institutions and other financing undertakings

No transitional licensing rules have been proposed for credit institutions or other financing undertakings. It remains to be seen if Norwegian authorities will provide any transitional rules leading up to Exit Day.

Norwegian investors

Brexit will introduce somewhat higher cost to access the Norwegian market for UK funds and fund managers. All else being equal, this would entail that fewer products will be marketed to Norwegian investors, and that they will have access to a smaller offering of products.

Institutional investors may be less affected by a reduced number of funds on the market, as they typically will continue to seek investment opportunities proactively. UK funds and fund managers may accept such investors on a reverse solicitation basis. UK managers should adopt appropriate procedures to document instances of reverse solicitation. With respect to non-professional investors, it is the view of FSAN that reverse solicitation will not apply.