Asset Management | Compliance & ESG – Norwegian and EU regulators just raised the bar on anti-greenwashing and SFDR compliance

Background

The Sustainable Finance Disclosure Regulation (SFDR) entered into force in Norway in January 2023. FSAN’s recent thematic inspection report[1] on selected investment firms and asset managers provides valuable insights into current market practices, as well as FSAN’s expectations and recommendations. Separately, guidance from ESMA[2] outlines how to ensure that sustainability-related claims are clear, fair and not misleading.

Collectively, these reports guides asset managers in ensuring SFDR compliance while reducing greenwashing risk. Below is a non-exhaustive summary of the regulators’ main recommendations.

In addition to these developments, the Danish Financial Supervisory Authority recently took action against three Danish asset managers for SFDR non-compliance (as noted in our previous newsletter here).

Main findings and recommendations from FSAN and ESMA

1) Sustainability risk

Under SFDR, asset managers must disclose on their websites and in pre-contractual documents how they integrate sustainability risk into investment decisions. However, many practitioners mix up risk (external factors affecting fund returns) with impact (how investments harm society or the environment). For example, marketing materials often refer to ESG ratings as “impact” when they typically measure only risk.

In addition, FSAN found that many managers provide insufficient information on how they identify, handle, and mitigate sustainability risk. This includes specifying data sources used, methods for risk evaluation, how it may impact budgets or internal valuations of investments, and how this is evaluated periodically. Internal resources, competence, training, and awareness on these topics also require more descriptive detail.

Key takeaway: Managers should review their website and pre-contractual disclosures on sustainability risk to ensure they are sufficiently detailed and meet FSAN’s expectations. Crucially, disclosures must distinguish between mitigating risks to maximise returns, and the positive or negative impact of investments on the environment or society. Even minor errors in these disclosures can heighten the risk of greenwashing.

2) Remuneration policy

Under SFDR, asset managers must disclose how their remuneration policy aligns with the integration of sustainability risk in investment decisions. FSAN found that most disclosures are too vague.

Key takeaway: FSAN expects more detailed explanations than a general reference to compliance with internal policies on sustainability risk when determining variable pay.

Key takeaway: FSAN expects also registered (sub-threshold) managers to explain how their guidelines for variable pay are consistent with integrating sustainability risk (although such managers are not required to implement a remuneration policy in accordance with the AIFMD).

3) Principal adverse impacts statement

The FSAN’s review indicates many managers fail to meet the detailed requirements for statements on “principal adverse impacts”. Generally, the FSAN found that the disclosures were too brief, oversimplified and lacking detail on methodology, data usage, prioritization of adverse impacts, how progress is measured, actions when no progress occurs, etc.

Key takeaway: Managers should review website disclosures on principal adverse impacts, adding thorough explanations of their policies and processes in line with FSAN’s expectations.

4) Certain Article 8 and 9 expectations

FSAN provided clarifications on the applicability of Article 8 and 9 in certain specific situations:

- A fund may exclude tobacco products and not be subjected to Article 8, provided that the exclusion is based on tobacco products being considered high risk (and this is communicated).

- A fund-of-fund may be subject to Article 6 even if it invests in Article 8 or 9 portfolio funds, as long as the fund-of-funds’ investment decisions do not consider the underlying funds’ sustainability performance.

- A feeder fund only investing in a master fund will generally be subject to the same rules as the master fund.

Otherwise, the FSAN made certain other observations concerning lack of sufficient information and documentation:

Key takeaway: Managers must establish and document clear criteria for assessing whether portfolio companies follow good governance practices.

Key takeaway: Website disclosures for funds under Article 8 or 9 must be publicly accessible, without login barriers.

5) Marketing, communication and greenwashing

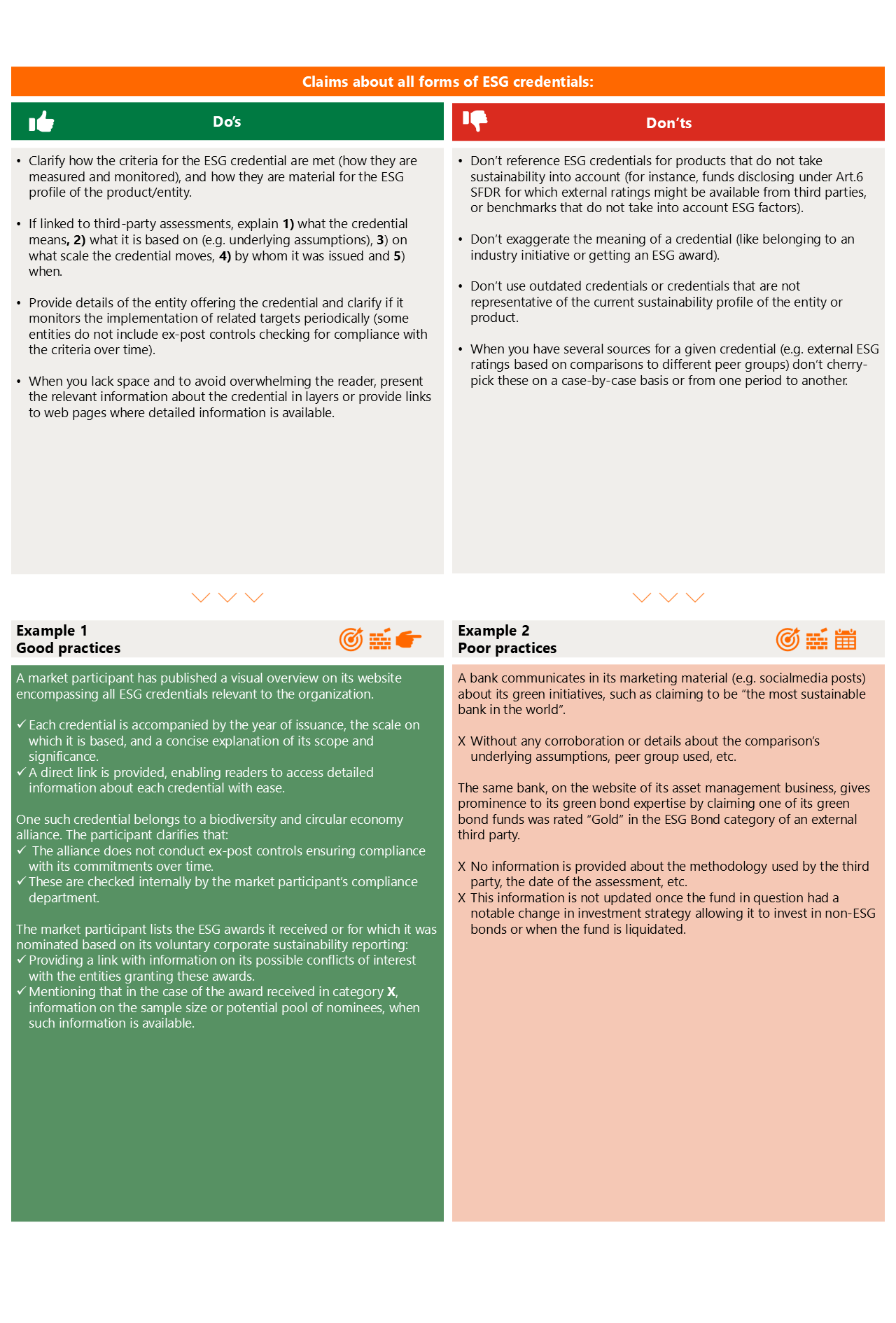

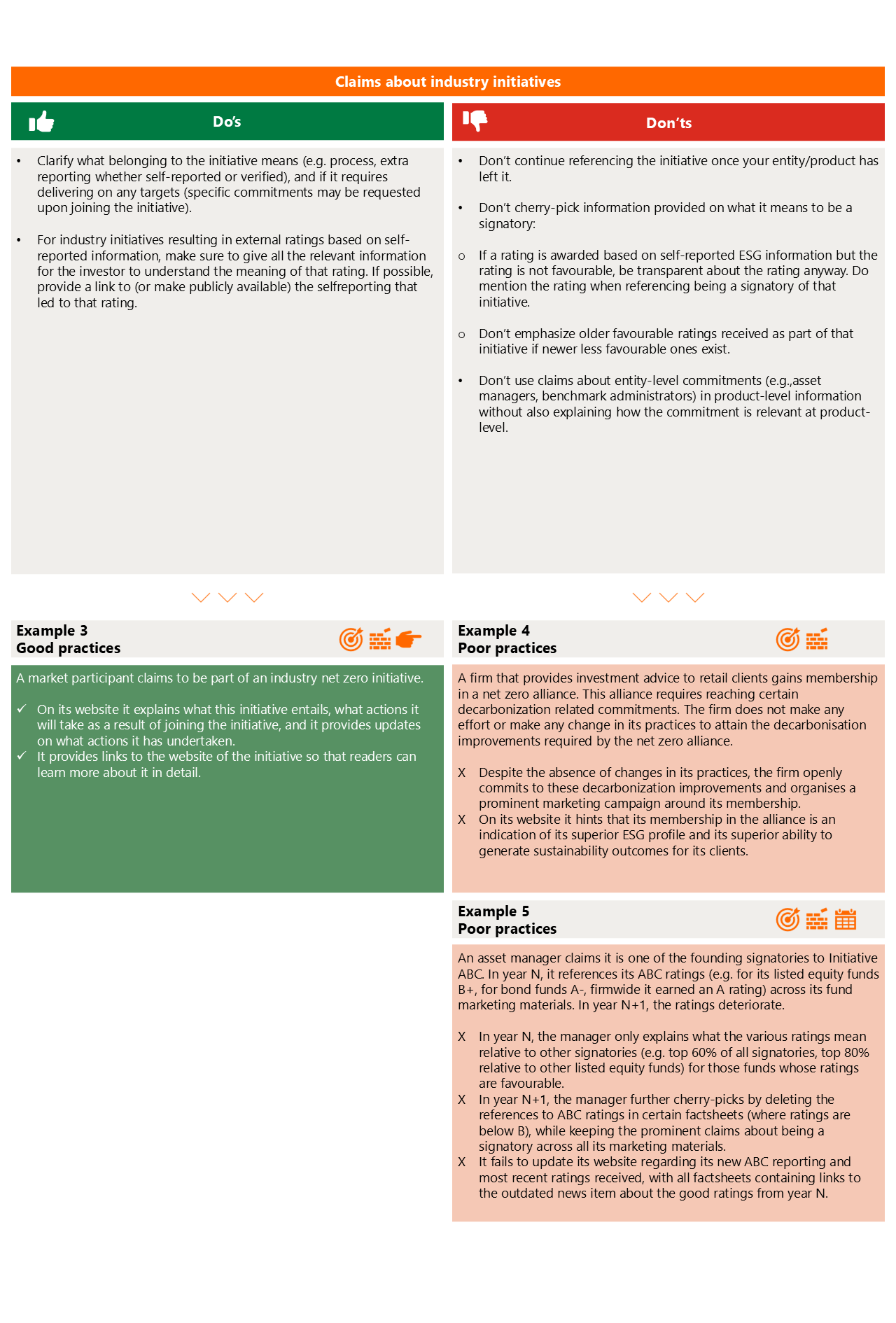

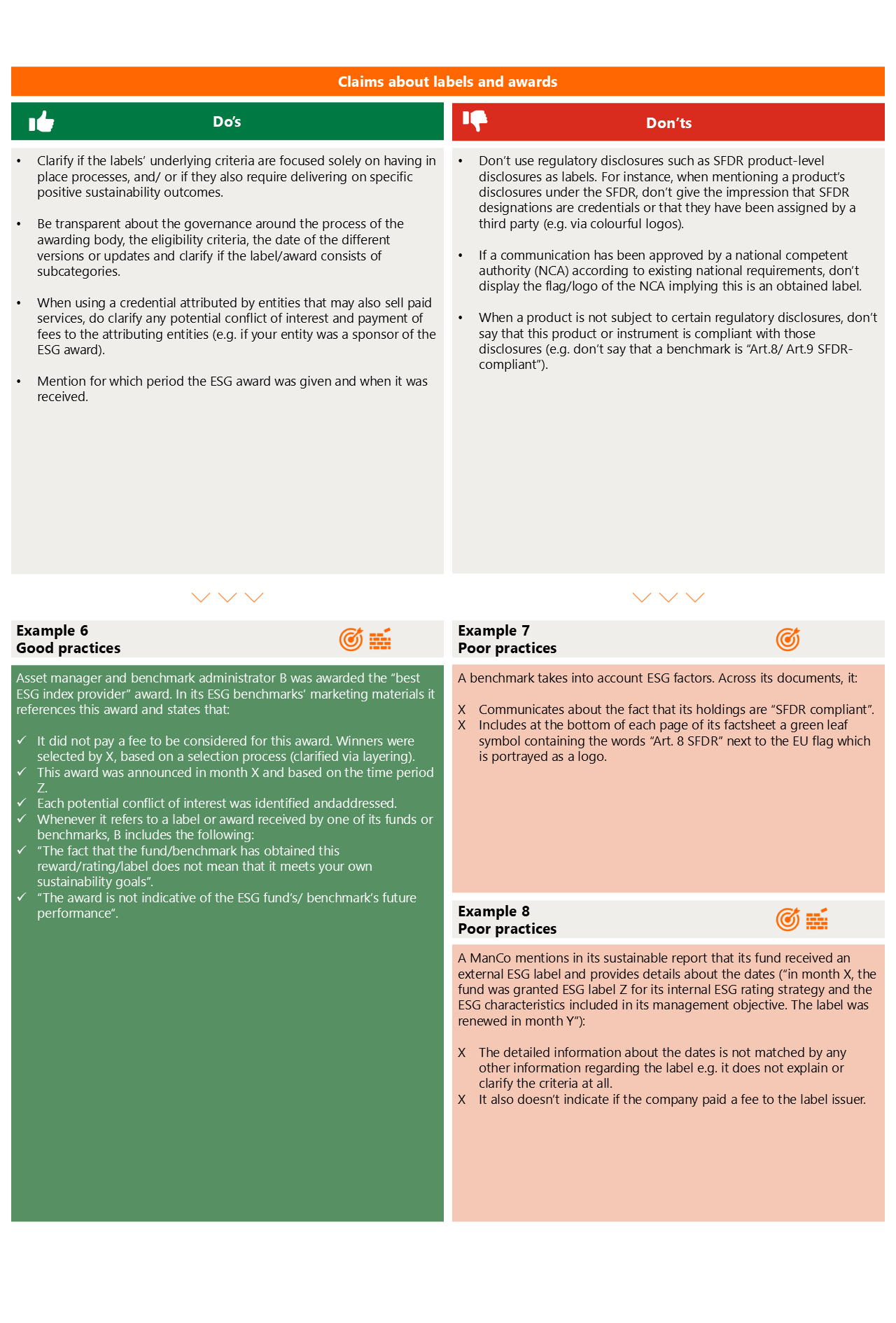

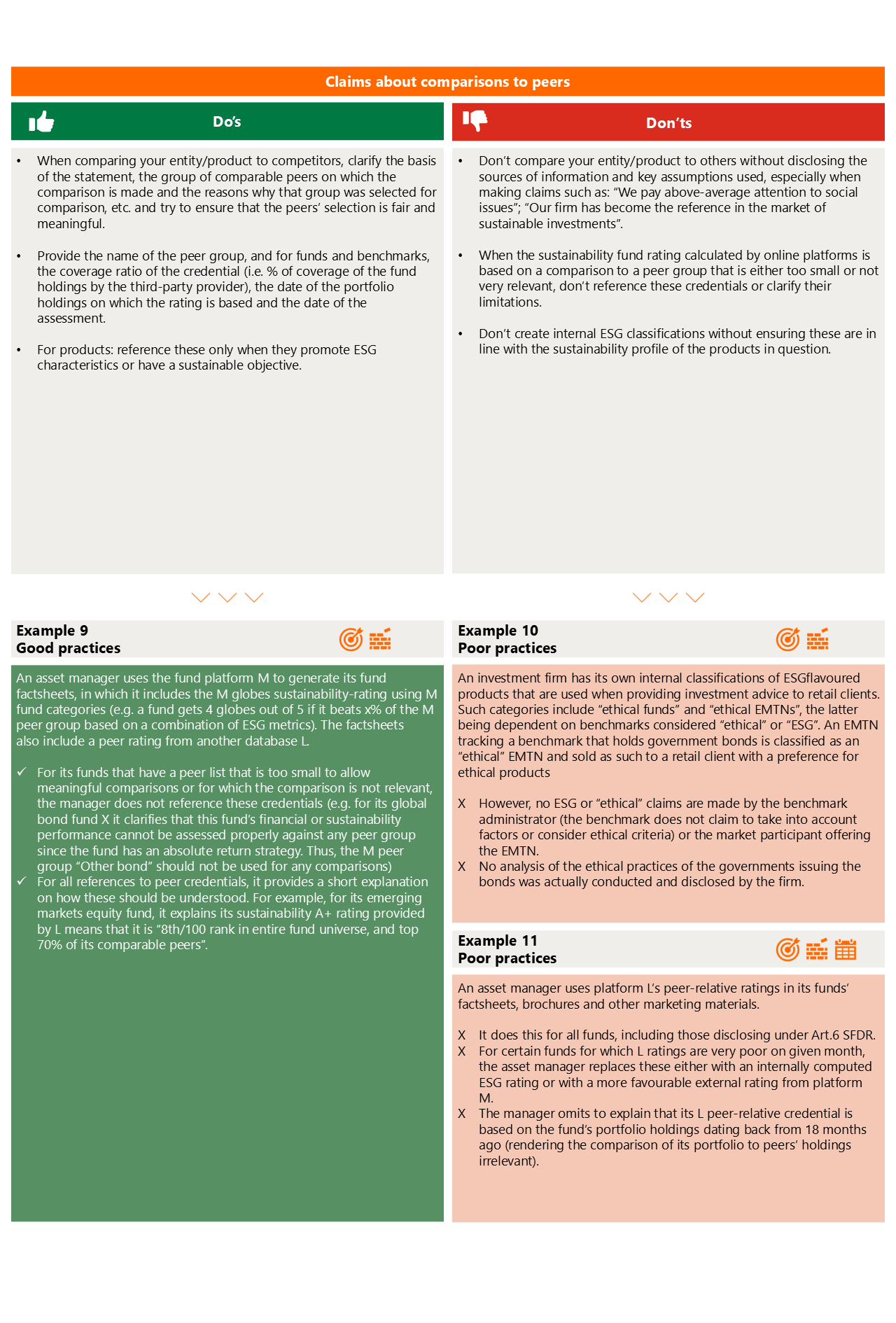

SFDR requires marketing materials to be accurate, fair, and not misleading. Both FSAN and ESMA provide in-depth guidance, including examples of good and bad practices. FSAN emphasises that it expects asset managers to be able to document all claims made. This should not be taken lightly. Furthermore, FSAN advises caution when using icons, colours, logos, and other visuals, particularly for documents aimed at retail investors. In addition, FSAN expects managers to maintain internal procedures outlining how they manage sustainability claims in external communications. Appropriate internal and external controls should be considered.

- At the end of this newsletter, we include ESMA’s highly illustrative and practical examples of do’s and don’ts and good and poor practices concerning sustainability claims in marketing materials.

BAHR comments

FSAN’s findings are largely unsurprising: they call for more detailed, concrete, and tangible information. While we believe most Norwegian managers only partially meet these expectations, consistent with the experiences of companies within the review’s scope, we note that FSAN has not identified any major risks or concerns. Instead, its recommendations focus on more detailed levels of compliance.

While SFDR focuses on disclosure, FSAN and ESMA push managers to provide genuinely informative content rather than mere “tick-the-box” reporting. Achieving this level of depth requires considerable time and internal resources, which can discourage some managers from pursuing more ambitious sustainability strategies. Nevertheless, FSAN acknowledges the substantial efforts already made, and our day-to-day work with Norwegian asset managers shows that they generally take sustainability issues seriously.

A challenge lies in striking a balance between increasing disclosure obligations and maintaining practicality and cost-effectiveness – while simultaneously avoiding over-disclosure, exaggeration and potential accusations of greenwashing. This balancing act applies at every marketing turn and strategic decision, such as when launching a new fund. When a new “SFDR 2.0” proposal is presented later this year (as noted in a previous newsletter here), we may gain further clarity on how these challenges will shape the long-term landscape for asset managers.

ESMA’s examples of good and bad practices:

[1] Offentliggjøring av bærekraftsrelaterte opplysninger fra verdipapirforetak og fondsforvaltere – Finanstilsynet.no

[2] ESMA promotes clarity in sustainability-related communications