The competition law year 2019 in review

This newsletter summarises some of the major developments in Norwegian competition law in 2019. Key highlights include the Norwegian Competition Appeals Tribunal (CAT) upholding the record fine of MNOK 788 imposed by the Norwegian Competition Authority (NCA) on Telenor for abusing its dominant position in the mobile market; for the first time in history the NCA intervened against a minority acquisition (Sector Alarm / Nokas); and for the first time the NCA conditionally approved a merger (Tieto / Evry) in Phase I. Last year, the NCA also increased its efforts to enforce the Norwegian Competition Act in the grocery sector. Looking into 2020, we expect even more focus on this sector.

ONGOING INVESTIGATIONS

- Enforcement work in in 2019 was marked by the initiation of three investigations; in the grocery market, retail fuel market and recycling market. In the grocery market, the NCA carried out dawn raids in November towards two suppliers and the largest chain in the grocery sector, following the NCA’s finding of significant differences in purchasing conditions amongst the Norwegian grocery retailers, see also “Focus markets” below. The NCA also launched an investigation into the retail fuel market to establish whether the prohibition against price coordination has been violated. In the recycling market, dawn raids were carried out in June in order to determine whether or not Stena Recycling and a local recycling company (Østbø) had engaged in bid-rigging. The case was however closed shortly after the dawn raid without any public statement.

- The NCA has in 2019 also continued to analyse evidence from dawn raids conducted in 2018 in two separate cases within the grocery and book publishing markets. The grocery market investigation relates to the grocery chains’ use of “price hunters”, i.e. the practice of scanning prices in competing stores, and the possible coordination of the terms for this practice. The book publisher case also relates to a suspicion of coordination.

ABUSE OF DOMINANCE

- In a two-to-one decision in June 2019, the Norwegian Competition Appeal Tribunal (CAT) upheld a MNOK 788 fine imposed by the NCA on the telecom operator Telenor for abusing its dominant position in the highly concentrated Norwegian mobile market. Norway is one of few countries in Europe with only two mobile network operators with a nationwide coverage; Telenor and Telia. In its decision, the CAT held that Telenor, through the introduction of a fixed per subscriber fee in the pricing model in its roaming agreement with the third mobile network operator at that time, Network Norway, reduced the incentives of Network Norway to roll out the third network by reducing the potential savings from moving traffic to its own network. The CAT also found that this was Telenor’s intention by reference to internal strategy documents indicating that the pricing model would limit the development of a third mobile network. The facts that the pricing model reduced the overall fees through a reduction in the variable costs, and did not, de facto, restrict the development of the third mobile network ware not deemed relevant.

The CAT also commented on the NCA’s calculation of the fine. The NCA had concluded that Telenor’s conduct was a serious violation of the Competition Act. In the calculation of the fine, the gravity factor was set to 2 percent by the NCA. The CAT criticised the NCA’s choice of gravity factor, saying a higher percentage should be used. The CAT did however not indicate an appropriate percentage or adjust the fine. The CAT’s decision is now pending before the Gulating Court of Appeal.

- In the market for supplies of beer to pubs and restaurants, the NCA has been concerned that agreements concluded by market leader Ringnes, a subsidiary of Carlsberg, may have hindered competing suppliers from access to the market, thereby weakening competition. The NCA carried out dawn raids in 2017. Ringnes has now offered the NCA a comprehensive set of binding commitments which intend to make it easier for pubs and restaurants to include beer from other suppliers in their assortment in order to bring an end to the dominance-abuse probe. The NCA has not yet concluded, but in February 2020 the offered commitments was subject to a public hearing.

RESTRICTIVE AGREEMENTS

- In June 2019, the NCA sent Sector Alarm and Verisure statements of objections in which it alleged that the companies for a period from 2011 to 2017 had engaged in an anticompetitive concerted practice in the Norwegian market for alarm services to residential customers. According to the NCA, Sector Alarm and Verisure coordinated their door-to door sales activities, agreeing not to approach each other’s customers. The NCA deems the alleged competition law offenses as very serious and considers imposing fines of MNOK 424.8 on Sector Alarm and MNOK 784 on Verisure. Sector Alarm immediately accepted the fine, whereas Verisure has submitted its comments to the statement of objections rejecting any collusive behaviour. A final decision from the NCA is expected in 2020.

- In 2017, the NCA fined several book publishers for coordination in form of a collective boycott of a distributor competing with a distributor partly owned by the publishing houses. The case is separate from the ongoing investigation of book publishers mentioned above. The 2017 decision was upheld, but fines adjusted, in a city court judgement of 2018. Some of the publishers have appealed the city court judgement which will be heard by the Borgarting Court of Appeal during the spring. A judgment is expected later in 2020.

PRIVATE ENFORCEMENT

- During the past year, the use of private enforcement within competition law has gradually increased and we expect more cases as a result of recent cartel and other competition infringement decisions from the NCA and the European Commission. Of particular interest is the follow-on claim by the Norwegian Royal Mail (Posten) group filed in 2017 against several foreign addressees (truck manufacturers) following an infringement decision from the European Commission, as well as against Volvo Norge, a Norwegian subsidiary of one of the other addressees. The defendants in the case challenged the jurisdiction of the Norwegian courts, arguing that only the case brought against the Norwegian subsidiary could be managed by Norwegian courts. In November 2019, the Norwegian Supreme Court issued a ruling clarifying that the claim for damages against the foreign defendants included in the infringement decision from the European Commission, can be cumulated with an alleged claim for damages for the same infringement against Volvo Norge, an “anchor defendant” that was not included in the infringement decision. The proceedings in Norway against Volvo Norge and the foreign defenders will therefore advance in 2020.

Please see also our earlier newsletter for further details on the legal questions before the Norwegian Supreme Court and an assessment of the ruling.

MERGER CONTROL

- For the first time in history, in November 2019, the NCA approved a merger with commitments in Phase I. The parties to the merger were Tieto and Evry, both providers of software and IT-services in Norway. The approval, which was granted after 35 working days, was subject to Evry divesting its case management and archiving solutions for public customers to address the NCA’s concern that the parties’ overlapping businesses would weaken competition in this market. The Tieto/Evry case illustrates that conditional approval in Phase I is possible where a competition problem is readily identifiable and can easily be remedied by the parties. The NCA has in the recent years also been more open to pre-notification dialogue, which is important in cases where Phase I remedies may be a possibility, amongst others to identify areas of concern and, where appropriate, to discuss possible remedies.

- In March 2019, the NCA conditionally approved an acquisition by the alarm service provider Sector Alarm of a minority shareholding post in its competitor Nokas. Initially, Sector proposed to acquire 49.99 percent of the shares in Nokas, as well as Nokas’ Small Systems business (security services to residential customers and SMEs). As the first transaction did not constitute an acquisition of control, and the second transaction did not trigger the notification thresholds in Norway, the transactions were not subject to the mandatory filing requirements of the Norwegian Competition Act. However, following a tip from the Swedish Competition Authority, the NCA ordered Sector to submit notifications for both transactions.

The NCA’s merger investigations revealed that both the Small Systems concentration and the minority acquisition would give Sector Alarm the opportunity to raise prices and influence Nokas’ strategic market behaviour in an already concentrated market. In this market, Nokas exerted an important competitive constraint. The NCA ultimately approved the transaction subject to multiple commitments offered by the parties. Most importantly, the parties committed not to execute the Small Systems concentration and to reduce the ownership stake in Nokas from 49.99 to 25 percent. Sector Alarm/Nokas constitutes the first case where the NCA uses its power to intervene against a minority shareholder acquisition, and shows that the NCA prioritises also non-notifiable transactions should they raise any competition concerns.

- In October 2019, the NCA blocked the proposed merger between the offshore accommodation vessel operator Prosafe and its rival Floatel. The transaction involved the two largest and closest competitors in the market for offshore accommodation services, and the NCA feared that buyers of accommodation services would have few or no competing suppliers if the transaction was allowed to proceed. The parties’ argument that, absent the merger, the current level of services would not be maintained due to a significant drop in demand was not approved by the NCA. During the investigation, Prosafe proposed remedies to remove the negative effects that would result from the transaction. The proposed remedies aimed at securing future supply in a situation where expected demand had dropped significantly. However, the NCA considered that the remedies were not sufficient to cater for the identified competition concerns. The transaction was thus blocked. The parties appealed the NCA’s decision to the CAT, but on 13 February 2020, the parties discontinued the merger before the CAT’s final decision, following the UK’s CMA publishing its provisional Phase II findings.

- The NCA announced in July 2019 that it considers imposing a fine of MNOK 20 on the grocery chain Norgesgruppen for breaching a special obligation levied on Norgesgruppen to report acquisitions in the grocery market below the thresholds for mandatory merger notification. Such obligations have been imposed on the main players in the grocery market as well as in other sectors where the NCA considers that competition is restricted and special attention is needed. The aim is to detect concentrations which call for the NCA’s attention, even when the notification threshold is not met. In Norway, the NCA has the power to order notification for such concentrations. The fine indicated by the NCA is significant, and demonstrates that the NCA looks seriously at breaches of the special obligation to report acquisitions.

Mergers in figures

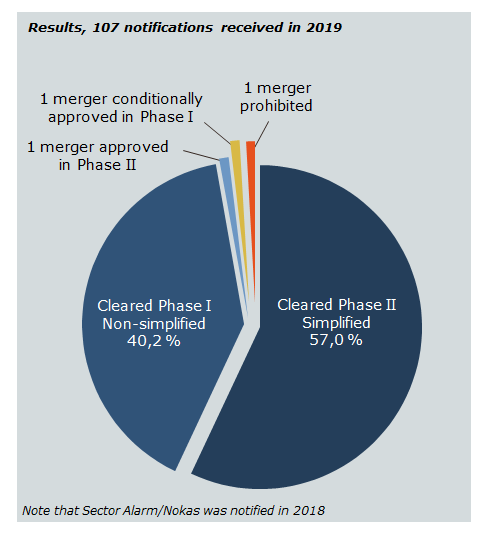

In the course of 2019, the NCA received 107 merger notifications, slightly less than the 110 received in 2018. Of these, the majority were cleared under the simplified procedure. The average time for clearance was 12.4 working days and 97 percent of notifications were cleared in Phase I.

FOCUS MARKETS

- The NCA has for many years advocated the need for a deregulation of the taxi market in order for new players with new business models to enter the market. Finally, in April 2019, the Parliament passed a bill on removing, amongst other things, the ceiling on taxi licenses in big cities and the requirement that the taxi profession is the driver’s main occupation. The new regulations also include investigating new technology-neutral solutions as a substitute for the traditional taxi meter, and are scheduled to be implemented in July 2020.

- Also the competitive situation in the groceries sector has continued to be a focus area for the NCA in 2019. In November 2019, the NCA published a report of its inquiry into differences in suppliers pricing and conditions to the grocery chains, revealing profound differences purchasing prices. The NCA found that the largest retail chain Norgesgruppen consistently is offered better prices than the two smaller chains. The results from the report led the NCA to initiate investigations against Norgesgruppen and two suppliers, Orkla and Mondelez, in order to assess whether or not the Norwegian Competition Act has been infringed, see also “Ongoing investigations” above. In a public statement, the NCA said it is concerned that large price differences can be harmful to competition and consumers both in the short and long term. In the short term, the NCA is concerned that large price differences can inflate prices. In the long term, the NCA is concerned with possible structural effects, as the price differences may hinder entry into the market, or force existing (smaller) grocery chains to leave the market.

Competition in the groceries market has also been subject to a fierce public debate during 2019. Numerous reports have also been published by authorities and market players, discussing the welfare effects of supplier price discrimination. While the reports emphasise different aspects, it appears to be a general opinion that the welfare effects are crucially dependent on why suppliers are discriminating between customers, a question to which no general conclusion appears to have been reached.

The Government is preparing a white paper to the Parliament, expected during the spring. The white paper is expected to discuss several issues raised by various market participants, including a suggested prohibition against supplier price discrimination and initiatives to break up the close integration between distribution and retailers in the market. In 2019, the Government further proposed a code of conduct for the grocery market as a new law to be enforced by a new groceries authority.

The NCA was in 2019 also allocated additional funding to establish a task force of 6-7 employees who will focus exclusively on the grocery market in addition to the general enforcement activities. The NCA’s activities related to the grocery sector can thus be expected to increase also in 2020.