Asset Management | Compliance & ESG – ESMA provides new guidance on communicating ESG strategies

The greenwashing challenge

Sustainability information influences investor choices, yet the complex nature of ESG data creates significant risks of misinterpretation. ESMA’s thematic notes recognise that misleading claims can arise through various mechanisms: cherry-picking positive information, exaggeration of ESG credentials, vagueness in terminology, inconsistent messaging, misleading imagery or omission of material negative factors. Crucially, greenwashing can occur both intentionally and unintentionally, at product or entity level, and whether or not current regulations specifically address the claim in question.

Four principles to follow

ESMA has established four complementary principles—Accurate, Accessible, Substantiated, and Up to date—that explicitly apply to all non-regulatory communication, whether oral or written and whether addressing institutional investors or retail investors. Non-regulatory information includes marketing materials, voluntary reporting and any other information that is not required by specific disclosure standards (e.g. fund prospectuses, management reports, funds’ KIDs, benchmark statements). Whilst these principles shall not create new disclosure requirements, ESMA calls market participants to acquaint themselves with the four principles to ensure that all are ‘clear, fair and not misleading’, as fund managers are already required to do under relevant ESG regulations, including the SFDR and the Cross-Border Distribution Regulation.

1. Accurate claims must fairly represent the sustainability profile without exaggeration or falsehoods, avoiding omissions and cherry-picking whilst ensuring ESG terminology and imagery align with the actual sustainability characteristics of the entity or product.

2. Accessible claims should not be oversimplistic but should be easy to understand. For short marketing materials aimed at retail investors, where the aim is not to overwhelm the reader with information, further substantiation can be presented to the reader in layers in the case of documents distributed in electronic format, ensuring substantiation is easy to find.

3. Substantiated claims require clear and credible reasoning based on fair, proportionate and meaningful methodologies. Limitations of data and metrics must be disclosed, and comparisons should clearly explain what is being compared and how.

4. Up to date claims must reflect current information, with material changes disclosed in a timely manner and clear indication of the analysis date and scope.

Guidance regarding ESG exclusions

ESG exclusion strategies commonly aim to avoid exposures prone to risks or to align portfolios with specific values or norms, typically through filters applied to investments, securities, sectors, regions or business practices. However, ESMA observes considerable divergence in market practices: exclusions may rely on more or less ambitious thresholds; they may or may not be based on materiality assessments relevant to the investable universe; and they may or may not significantly reduce the investment universe or impact portfolio composition.

✓ DO’s

- Describe the process in plain language – Explain clearly how ESG exclusions are implemented, including the process, ESG criteria and thresholds used

- Clarify absolute vs threshold-based exclusions – State whether ESG exclusions are defined in absolute terms or based on thresholds, and whether thresholds apply to all criteria or only some

- Disclose materiality assessment approach – Be transparent about whether the ESG exclusions strategy relies on a materiality assessment, and if so, whether this is single or double materiality

- Quantify impact on investable universe – Be clear about the level of impact of the exclusions on the investable universe and/or on the final portfolio composition, especially if these are negligible

- Clarify firm-wide vs tailor-made exclusions – For claims about a product’s use of ESG exclusions, clarify if the exclusions are defined following a firm-wide policy of the fund manager and/or whether they are tailor-made to the specific funds’ investment universe

✗ DON’Ts

- Don’t claim ESG exclusions without defined criteria – Don’t claim to adopt an ESG exclusions strategy if the exclusion rules are not based on defined criteria and applied consistently

- Don’t overstate sustainability profile – Don’t emphasise superior sustainability unless supported by: i) materiality of the exclusion criteria, ii) ambition of the thresholds used, and/or iii) actual impact on investable universe or portfolio composition

Guidance regarding ESG integration

ESG integration strategies generally aimed at improving risk-adjusted returns by factoring material ESG risks and opportunities into investment analysis and decision-making. Here too, practices diverge: ESG integration may be binding or non-binding; it may or may not trigger action when material ESG factors change; ESG factors may play a key or merely adjacent role in portfolio construction; and they may or may not be material for the investments, whether this be based on financial (or single) materiality or on an assessment of sustainability impact in the real economy (double materiality).

✓ DO’s

- Define the term clearly – When using “ESG integration”, explain what it means the first time it appears in the communication using plain language

- Use illustrative examples – Try to provide concrete examples to clarify abstract terms and describe how ESG factors are considered in portfolio construction

- Disclose binding nature – State whether ESG integration is binding or non-binding

- Explain decision triggers – Clarify whether ESG factors trigger portfolio decisions and whether they play a key or merely adjacent role

- Describe extent of financial analysis – Explain the extent to which ESG factors are used in the financial analysis of investments

- Quantify portfolio impact – Disclose the actual impact on portfolio composition

- Specify integration level – Clarify at which level ESG integration occurs (e.g. fund level and/or portfolio level)

- Disclose varying ambition levels – Be transparent about differences in ambition across asset classes, sectors, and process steps

- State materiality approach – Clarify whether the strategy uses single or double materiality

- Clarify risk vs opportunity focus – Explain whether the approach considers only risks or also opportunities

✗ DON’Ts

- Don’t use as umbrella term – Don’t use “ESG integration” to describe other ESG strategies (exclusions, best in class, etc.)

- Don’t make vague entity-level claims – Don’t claim “X% of AUM is ESG integrated” without clarifying whether this includes only ESG integration or other ESG strategies too

- Don’t misrepresent benchmark-tracking products – Don’t claim ESG integration if neither the product nor its ESG benchmark actually implements the strategy

- Don’t overstate sustainability profile – Don’t emphasise superior sustainability unless supported by: i) key role of ESG factors in portfolio construction, ii) extent of integration in financial analysis, and/or iii) actual impact on portfolio composition

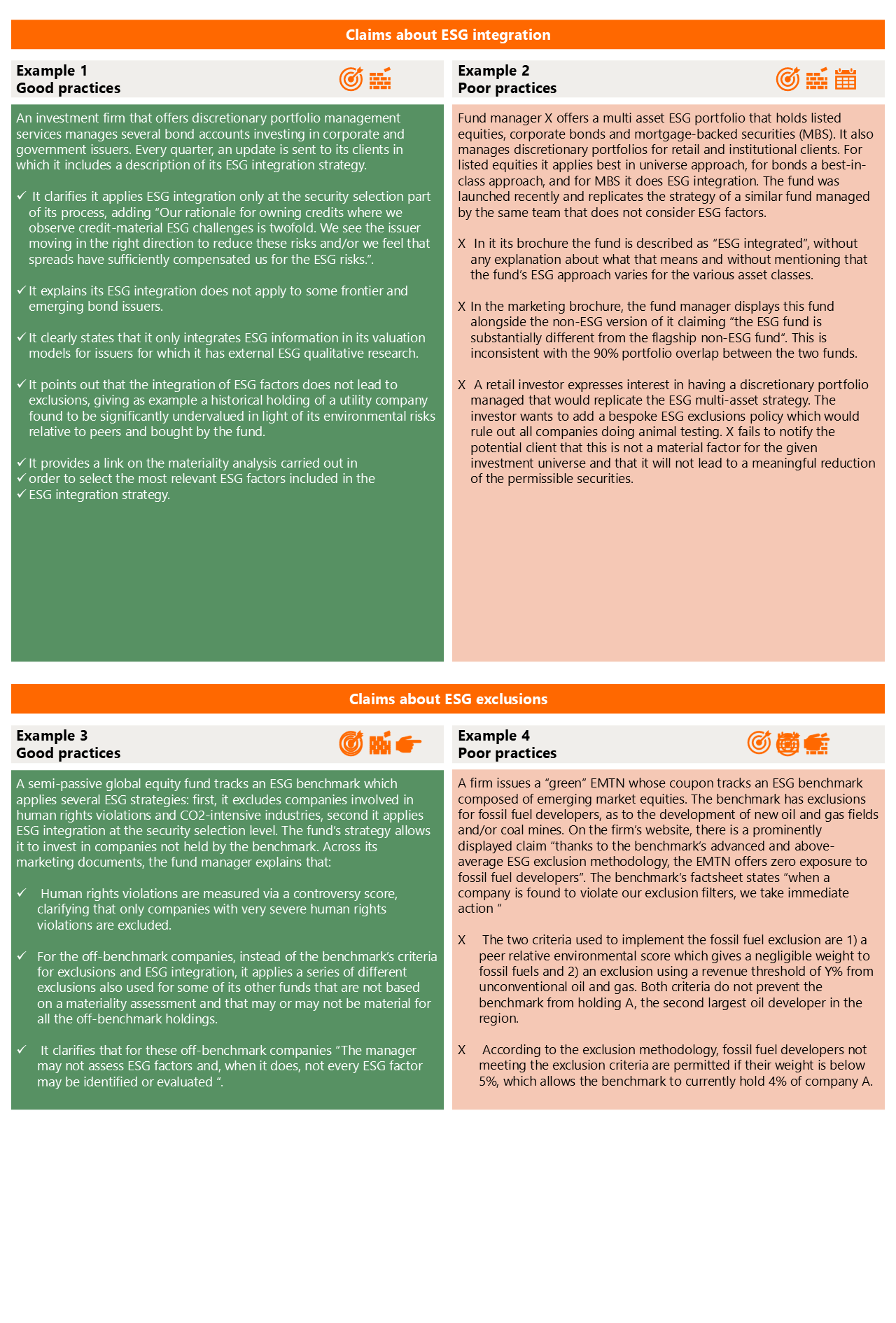

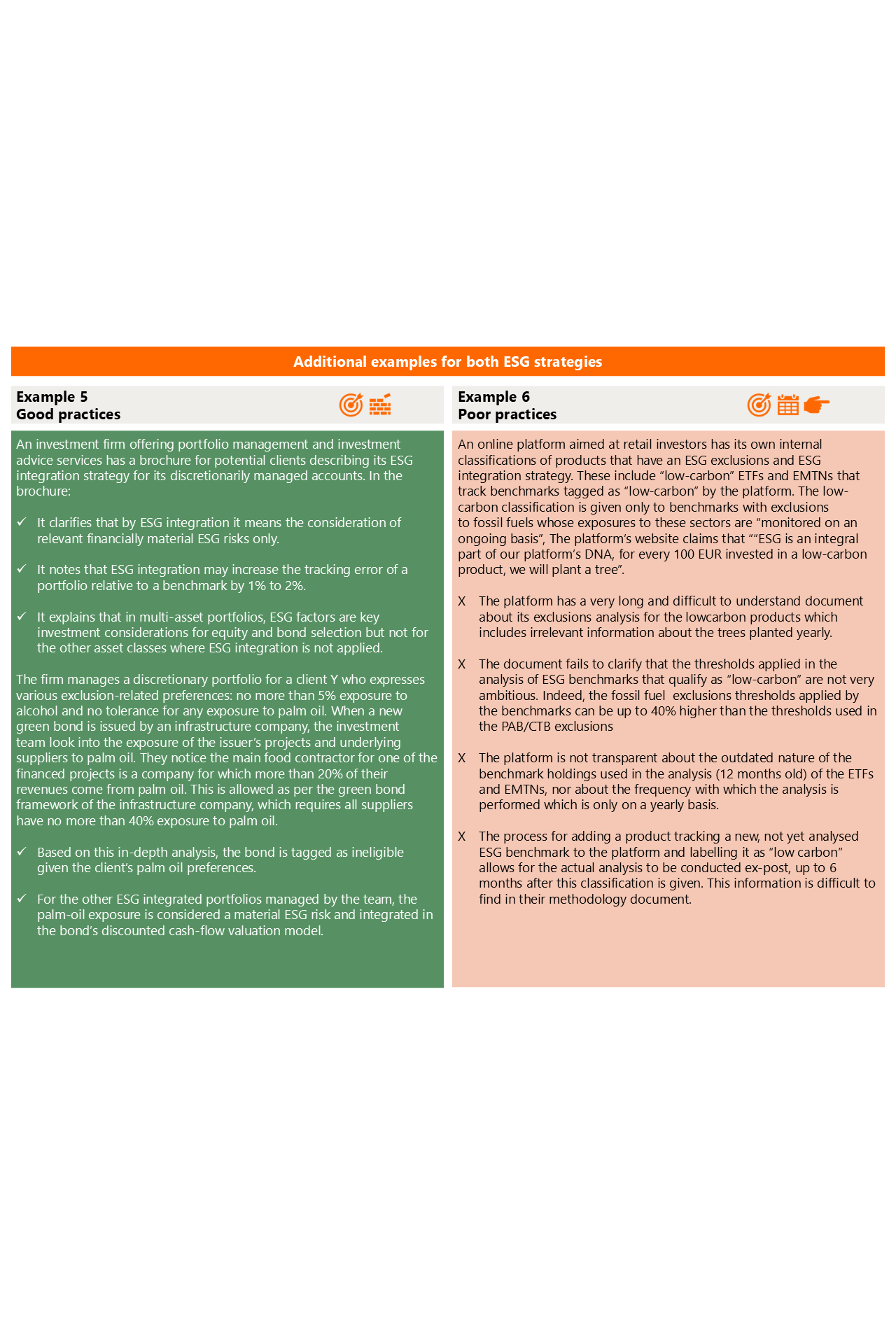

ESMAs practical examples

BAHR comments

The new guidance is relevant for fund managers when developing investment strategies and drafting relevant documentation that will be communicated to investors such as, for example, marketing materials, investor presentations (both oral and written), website content, DDQs, PPMs, voluntary reportings and disclosures. Misleading sustainability claims can trigger supervisory action, reputational damage and loss of investor trust. Fund managers should make sure to review and monitor communication accordingly. We recommend to read ESMA’s new guidance in conjunction with the expectations laid out in its first note, published on 1 July 2025, which we have discussed here.

ESMA’s focus on sustainability claims reflects growing regulatory and investor scrutiny of ESG marketing practices. For fund managers, the challenge lies not only in developing ESG strategies but in communicating them in accordance with regulatory expectations. With sustainability information remaining a key driver of investor allocation decisions, fund managers that proactively align their communications with ESMA’s principles can build trust whilst avoiding the legal and reputational pitfalls of greenwashing.

ESMA’s thematic note can be found here.