Asset management – Compliance & ESG | SFDR 2.0 – The first draft of the European Commission proposal leaked and shows substantive changes in scope and requirements

Please note that the below is based on the leaked draft of the European Commission’s proposal and that the final text of the regulation may change in the final version to be approved by the co-legislators and published.

1. Three categories of sustainability-related financial products

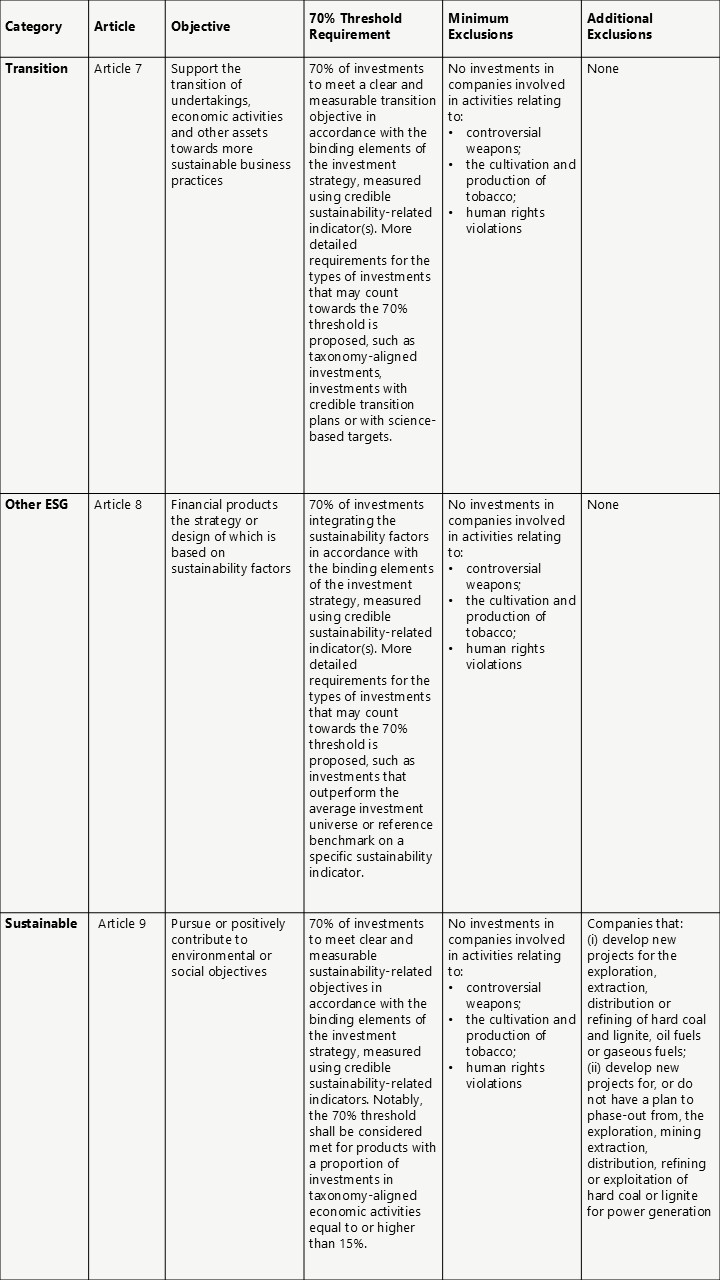

The proposal effectively discards the current regime with Articles 6, 8 and 9 products and establishes three new categories for sustainability-related financial products. Notably, the new categories establish material portfolio composition requirements for each category, and not just disclosure and reporting obligations. The new categories distinguish financial products based on whether their main objective is to:

- Support an environmental or social transition-related objective (Transition)

- Integrate other sustainability considerations as part of their strategy (Other ESG)

- Pursue an environmental or social sustainability objective (Sustainable)

2. Removal of “sustainable investment” concept from SFDR

The definition of ‘sustainable investment’ in the current SFDR has generated “a considerable number of practical implementation challenges and concerns, queries to supervisors about interpretation and their expectations, and wide divergence in practical application” according to the European Commission.

As a consequence of the revised categories of sustainability-related financial products, the European Commission proposes to delete the definition of sustainable investment from the SFDR. None of the three new categories refer to “sustainable investment” in their objectives or portfolio composition requirements, other than references to taxonomy-aligned investments. In consequence, only the taxonomy will be an authoritative source for determining (environmentally) sustainable investments.

3. Removal of “principal adverse impact” concept

The requirements for financial market participants to make disclosures on “entity level” of their consideration of principal adverse impacts and accompanying mandatory indicators are proposed deleted. The main reason for moving away from PAI disclosures at entity level is presumably not to duplicate the disclosures set by Directive (EU) 2022/2464 (CSRD). PAI disclosure at entity level and its prescriptive and mandatory nature has been a burdensome process for many Norwegian managers.

Furthermore, PAI consideration on “product level” is also removed. Instead, it is proposed to be replaced with mandating financial market participants to apply a common set of clear exclusions covering practices and sectors which are commonly agreed to be most harmful as set out in the table above for each new fund category, reflecting the new approach with establishing portfolio composition requirements rather than purely disclosures.

4. Streamlined product-level disclosure requirements

Pre-contractual disclosure requirements for sustainability-related financial products are tailored to the three new categories. Specific disclosure requirements are established which aim to require asset managers to substantiate how they intend on meeting the portfolio composition requirements that apply for each specific category. It is proposed that a delegated act will be adopted to supplement the pre-contractual disclosure requirements, similar to the current system, but apparently providing for more tailored disclosures, which likely will be an improvement. Such pre-contractual disclosures shall be limited to two pages only.

It is proposed that the website disclosures pursuant to Article 10 for sustainability-related financial products shall consist of the pre-contractual disclosures and the periodic reports issued by the product in accordance with the revised SFDR.

5. Sustainability risk disclosures remain

Both Article 3 on transparency on sustainability risk policies at entity level, and Article 6 on transparency on integration of sustainability risk in pre-contractual disclosures for financial products remain in force for financial market participants. Consequently, Finanstilsynet’s latest guidelines and recommendations are likely to remain applicable and relevant (see our Newsletter here).

6. Marketing restrictions for products that are not categorised as sustainability-related financial products

A new Article 6a titled “Voluntary transparency on the integration of sustainability factors in pre-contractual disclosures for products that are not categorised as sustainability-related financial products” is proposed. This establishes that financial market participants shall not be prevented from including in the pre-contractual documentation of financial products other than those categorised as sustainability-related financial products pursuant to Articles 7, 8 or 9, information on whether and how those financial products consider sustainability risks and sustainability factors.

However, such information:

- Must not be used in the name or marketing communications of the financial product

- Must not be a central element of the pre-contractual disclosures

The information shall be considered not to be a central element where it is secondary to the presentation of the product characteristics (both in terms of breadth and positioning in the document), is neutral, and is limited to less than 10% of the volume occupied by the presentation of the financial product’s investment strategy.

This creates a more lenient regime compared to the current SFDR, where products not disclosing under Article 8 or Article 9 are highly restricted from referencing sustainability in marketing communications beyond risk management.

7. Removal of financial advisers from scope

Financial advisers providing investment advice and portfolio management are carved out of the scope of the SFDR altogether.

8. Recognition of impact investing

Within the categories of products with sustainability and transition-related objectives, recognition is given to the practice of impact investing, acknowledging its specific characteristics, including the objective of intentionality and targeting measurable change in specific pre-defined environmental or social areas with an upfront theory of change and with reporting on the outcomes.

For financial products with a sustainability or transition objective, the information to be disclosed shall also include:

- the intended impact(s) in terms of specified environmental or social objectives, underpinned by a pre-set impact theory and expressed in terms of key performance indicator(s); and

- provisions to measure, manage and report on the desired impact pursuant to point (a), including in terms of investments by the financial product and the contribution of investors in the financial product.

Financial products other than the new “sustainability-related financial product with impact” shall not use the term ‘impact’ in their names.

9. Application to funds that are closed when the revised SFDR enters into force

The proposal specifically excludes from its scope closed-end financial products that are closed to new investors and would no longer be offered to investors after the date of application of the revised SFDR. This does not prevent asset managers from adopting the new rules on a voluntary basis, to the extent this does not conflict with existing investor requirements or other legal obligations. However, this approach – if adopted by the co-legislators in the EU – provides clarity for asset managers that existing funds will not be required to make amendments to fund strategies, agreements, disclosures etc.

10. Exemptions for alternative investment funds exclusively marketed to professional investors

Importantly, the European Commission has proposed that alternative investment funds which are offered exclusively to professional investors may also opt out of applying the rules on sustainability-related financial products, which includes the requirement to categorise funds and make accompanying disclosures and reports available. The European Commission bases this proposal on such funds not being “marketed widely beyond a smaller community of investors so information asymmetries are less likely to manifest”. This means that Norwegian asset managers only marketing to professional investors may apply a more lenient regime if the new rules are adopted.

Two elements should nevertheless be considered. Firstly, marketing communication and fund naming rules are likely to still apply, as well as general principles requiring that communication, marketing materials and disclosures do not contradict the SFDR and are clear, fair, and not misleading. Greenwashing risk may still exist even though such funds may be able to opt out.

Secondly, while such funds may be permitted to opt out, it is likely that (EU based) institutional investors may still require fund managers to provide them with adequate disclosure and reporting on sustainability, which may pave the way for the revised SFDR’s fund categories and accompanying disclosures to be applied on a voluntary basis due to market and investor expectations.

Requirements to disclose sustainability risks for such products are maintained.

11. Anticipated timeline

After the official draft of SFDR 2.0 is published, it is estimated to take around 18-25 months for the legislative process to complete (based on average EU regulation timelines). The indicative timeline is:

- Q4 2025: Draft publication

- Q4 2026 – Q1 2027: First reading in European Parliament and Council

- Mid – end 2027: Adoption of the new regulation (in the EU)

Norwegian asset managers marketing funds in the EU will likely be required to apply the new rules from the EU effective date, whereas Norwegian asset managers solely marketing funds in Norway can wait for implementation into Norwegian law, if this occurs later.

BAHR comments – what should Norwegian asset managers do now?

Funds currently in the fundraising process are unlikely to be impacted by the revised rules, as fundraising periods typically extend from 12-18 months and the new rules are unlikely to enter into force prior to mid – end 2027. Funds that are closed when the revised rules enter into force will, based on the proposal, not be required to adopt the new rules, but may do so voluntarily.

For fund managers that establish funds expected to be fundraising in mid – end 2027 (or later), the new rules will likely be relevant. We recommend that managers:

- examine the proposed fund categories to have a view on which category their investment strategy may be aligned with, notably with regard to the 70% threshold and minimum exclusions;

- consider whether a fund marketed to professional investors only might benefit from an opt-out and how this affects investors’ appetite; and

- draft the fund documentation with sufficient flexibility to ensure that the manager may align the fund with the finalised revised rules if this is deemed in the best interests of the fund. Note that funds must adhere to the current version of SFDR if established prior to SFDR 2.0 entering into force, so it is advisable to develop a ‘conversion plan’ from SFDR to SFDR 2.0.

While the European Commission’s proposal to exempt alternative investment funds marketed to professional investors only from fund category requirements and related disclosures and reporting, it should be noted that this is not yet determined by the co-legislators, who may diverge from the European Commission’s proposal. It is also uncertain how the market and investors may adapt to such rules if and when adopted, and their views on voluntary application.

The revised SFDR framework is part of a long-awaited simplification initiative of the European Commission to overcome shortcomings associated with the implementation of the SFDR and to significantly simplify administrative burdens while allowing investors to efficiently understand and compare sustainability-related financial products. Asset managers and sustainability-focused investors will benefit from a simple product categorisation system with harmonised ESG rules for fund names, marketing and distribution. The categories establish minimum ESG performance standards that screen out investments unacceptable to most sustainability-minded investors, strengthening protection against greenwashing. The regulation will be clearer, simpler to apply, and less costly than current rules, whilst reducing risks of inconsistent national implementation.