Asset Management – Private Equity – M&A | ESG and Sustainability Due Diligence in M&A: Mitigating Serious Legal Risk, While Enhancing Value Creation

ESG & Sustainability: A Catalyst for M&A Success

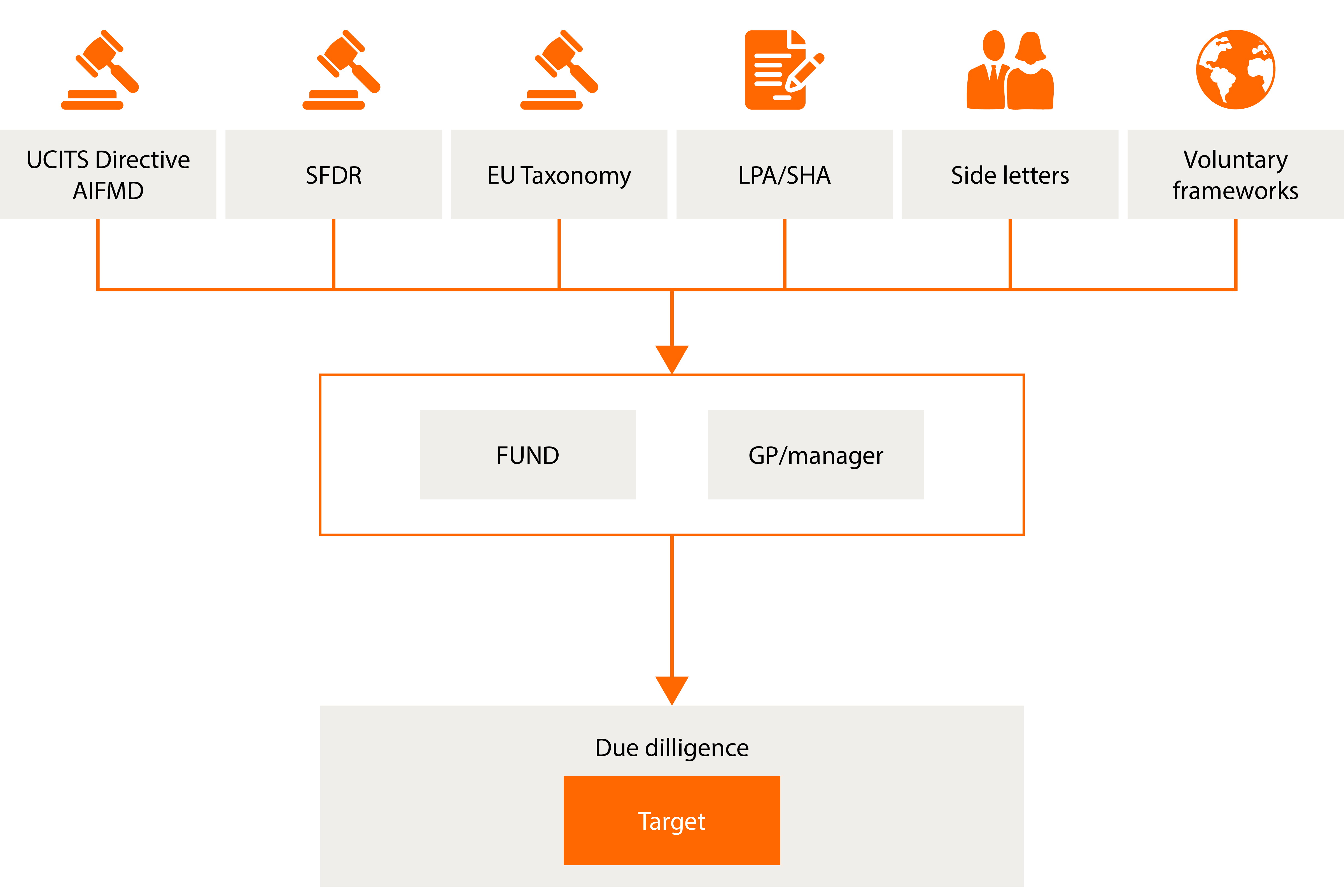

ESG and sustainability due diligence in M&A processes is no longer optional for asset managers; regulated managers are required to assess sustainability risks under the AIFMD, the UCITS Directive, and SFDR. Beyond that, many funds and managers have committed to voluntary frameworks, such as the UN Principles for Responsible Investment, the OECD Guidelines for Multinational Enterprises, and the UN Global Compact, which further shape their investment criteria and processes.

Failure to properly account for ESG factors can lead to regulatory scrutiny and fines, litigation, and reputational harm. It can also diminish investor confidence, hinder future fundraising efforts, and in severe cases, result in suspension of licences or forced restructuring. In certain jurisdictions, failing to conduct thorough ESG due diligence may expose fund managers to potential criminal liability if the portfolio company or its previous owners have engaged in unlawful practices. Ensuring comprehensive ESG procedures, coupled with strong compliance controls and immediate remediation steps if wrong conduct is discovered, can help mitigate these serious legal risks. These potential consequences underscore the need for thorough ESG due diligence in M&A processes.

In a recent example from Denmark, a manager who proclaimed alignment with UN Global Compact, Universal Declaration of Human Rights, and ILO Conventions failed to incorporate these frameworks into its M&A due diligence and faced regulatory consequences. This highlights how asset managers may be exposed if their M&A activity is not aligned with the commitments made in marketing and other external material.

While ensuring compliance with ESG and sustainability requirements is frequently discussed in the context of M&A, the topic of ESG and sustainability in M&A goes far beyond mere box-ticking or compliance exercises. A well-structured ESG and sustainability due diligence can unveil liabilities potentially affecting the purchase price, negotiation strategies, and post-closing integration steps. At the same time, it can highlight operational improvements or market differentiation opportunities—contributing to a more resilient and value-driven outcome.

Heightened-Risk M&A Scenarios: Key Reasons to Prioritise ESG & Sustainability

In certain M&A deals, specific characteristics can substantially increase ESG and sustainability risks, demanding a more comprehensive approach to ESG due diligence. These heightened-risk scenarios—ranging from complex supply-chain networks to high-intensity emissions profiles—can expose fund managers to reputational, regulatory, and financial pitfalls if ESG factors are not rigorously assessed and integrated into the overall transaction strategy.

- Dual use technologies: Where a target offers products with potential dual-use applications (civilian and military), asset managers must conduct rigorous due diligence around export controls, foreign direct investment (FDI) restrictions, and broader public policy risks. With booming interest from private equity in the defence sector, this is a highly relevant situation. Although compliance is crucial, proactively navigating these regulatory frameworks can uncover market expansion possibilities and address emerging needs in growing sectors (e.g., defence). Thorough pre-transaction due diligence also lays the groundwork for smoother closing and mitigates the risk of post-closing investigations of potential breaches that might otherwise undermine the intended value creation.

- Supply-chain heavy target: A target with extensive supply chains may involve heightened labour and human rights risks, particularly if raw materials or products are sourced from regions with weak regulatory frameworks. Beyond simply avoiding legal or reputational harm, in-depth ESG and sustainability due diligence can unveil opportunities to refine supplier relationships, reduce operational inefficiencies, or innovate around responsible sourcing. By reviewing possible risk hotspots early, the buyer may pursue contractual safeguards or even restructure high-risk units – moves that can enhance the target’s value through improved governance, more stable supply chains, and stronger brand reputation.

- High-emitting target: When a target operates in an emissions-intensive sector (e.g., heavy industry), ESG-driven due diligence should address carbon-related liabilities and potential regulatory changes that might affect the business model. Factoring in these issues proactively may lead to price adjustments, covenants, or warranties that properly account for emissions risks. Meanwhile, it can also uncover possibilities: for instance, the target might qualify for green incentives or green financing, or a strategic upgrade of its facilities could cut operating costs or generate other synergies. By connecting findings to concrete cost-saving measures and possible expansion into more sustainable practices, buyers can strengthen their immediate negotiation position and the target’s long-term competitiveness.

How Fund Managers can navigate for a robust M&A due diligence process related to ESG and Sustainability

While the overarching significance of ESG factors has already been established, ensuring the success of ESG due diligence in an M&A setting depends on having both a clear structure and a tailored methodology. A highly customised process aligned with the target’s unique risk profile, regulatory environment, and industry context, enables informed strategic decisions. A structured recipe not only captures the most relevant ESG risks but also illuminates value-enhancing opportunities that might otherwise be overlooked. The result is a stronger, more transparent foundation for deal-making with enduring benefits for all stakeholders.

BAHR has assisted clients with ESG diligence in a number of situations, and has developed a structured approach, yet tailoring each case to the target at hand and relevant circumstances:

Step 1: Initial mapping of the target’s ESG exposure

- Identify the ESG and sustainability requirements for the fund, manager, and target, ensuring any unique deal-specific or sector-specific considerations are captured.

- Upfront clarity avoids duplicative or irrelevant investigations.

Step 2: Risk-based scoping specifically aligned to the target’s operations

- Prioritise ESG issues based on target’s industry, region, transaction size, regulatory triggers and risk appetite.

- Focus on the major deal drivers, where findings may contribute to expedite negotiation and assess, e.g., contractual protections and governance mechanisms.

- Align ESG due diligence with legal, financial, tax, and commercial workstreams to ensure comprehensive coverage, while avoiding duplicate efforts, enabling advisors to focus their advice.

Step 3: Assess specific and material ESG risks and opportunities

- Map findings to the fund’s commitments (e.g., SFDR criteria or side letters) for internal compliance checks and sign-off.

- Ensure that senior legal team members understand whether closing conditions or special indemnities are required.

Step 4: Post-closing measures following the transaction

- Draft and negotiate robust transition services agreements or post-closing covenants that address ESG improvement plans.

- Incorporate identified ESG gaps into broader compliance and governance frameworks to reduce risk of future disputes or regulatory issues.

3 Key takeaways for Norwegian asset managers

In our view Norwegian fund managers could benefit further strengthening their focus and approach to ESG and sustainability when it comes to M&A process. Despite already being on the agenda, there is still room to improve. Specifically, we see three areas when it comes to ESG and sustainability in an M&A context where it is room to differentiate, to ensure the efforts put in result in actual value creation and is not reduced to a box-ticking exercise.

- Elevate ESG to a core M&A pillar: By weaving ESG into the strategic rationale of the deal – rather than treating it as an add-on – fund managers can achieve a more holistic valuation and understanding of the target and its value chain.

- Stay ahead of regulations: Given the fast-evolving ESG and sustainability rules within the EU, anticipating changes can help shape more effective and efficient M&A processes.

- Focus on long-term value, not just risk mitigation: Solid ESG evaluation can reveal opportunities for operational improvements, cost reductions, or future market expansion. Integrating these findings into the broader M&A strategy enhances both the near-term negotiation dynamics and the long-term portfolio outlook.

ESG and sustainability considerations can play a critical role in M&A deal success – from due diligence, contractual drafting, and post-closing obligations. By employing a risk-based, deal-centric approach, M&A teams can carry out efficient and robust M&A processes that meet regulatory requirements without adding unnecessary burden on deal teams, sellers or the management team of the target. Above all, weaving ESG imperatives into the core of the M&A process can proactively uncover hidden risks and liabilities, safeguard reputations, and contribute to long-term value for managers and investors alike.