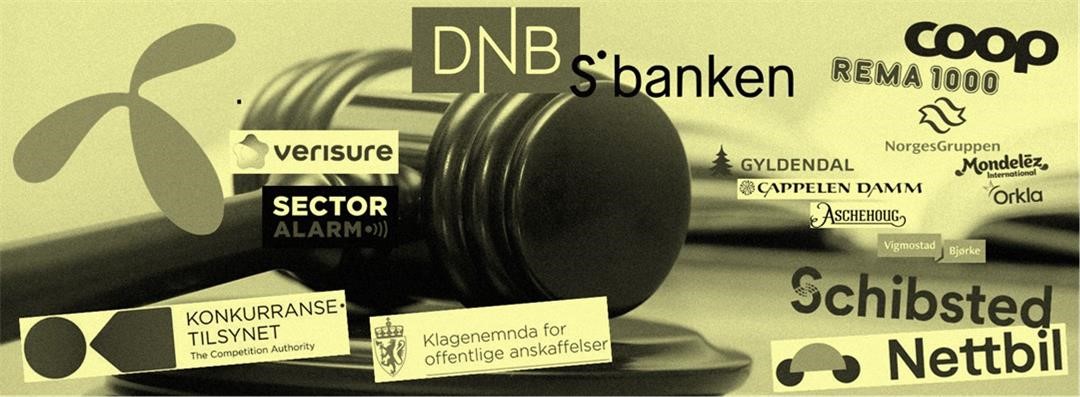

Competition, state aid and public procurement in Norway: 2021 in review – and what has happened so far in 2022?

Key highlights within antitrust enforcement in 2021 include:

- The NCA’s continued focus on the grocery market, most remarkably in an ongoing case where SOs have been issued to the three major grocery chains indicating combined fines of MNOK 21 000 (MEUR 2 100) for their agreement not to prevent each other from observing actual prices in each other’s stores;

- Final decisions in favour of the NCA in prominent cases:

- The Supreme Court upheld the NCA’s fining decision to publishers engaged in a collective boycott;

- The Court of Appeal upholding the fine of MNOK 788 (MEUR 78) against incumbent telecom operator Telenor for abuse of dominance; and

- The Competition Appeals Tribunal (“CAT”) upheld the NCA decision against home security supplier Verisure with a fine of MNOK 766 (MEUR 76) for market sharing with competitor Sector Alarm.

The start of 2022 has been more troublesome for the NCA. In March 2022, the CAT reversed the NCA’s prohibition of the merger between Norway’s leading bank DNB and its rival Sbanken. The decision is final. A week later, the Court of Appeal annulled the NCA’s decision to prohibit the media house Schibsted’s acquisition of Nettbil. The decision had previously been upheld by the CAT in 2021. It is not yet clear if the NCA will appeal the decision to the Supreme Court.

The public procurement field is increasingly being characterized by court cases concerning higher contract values. Unsuccessful bidders in tenders often challenge award decisions. Within state aid, 2021 represented another year of comprehensive pandemic and COVID-19 aid measures. In the beginning of 2022, the European Commission’s Guidelines on state aid for climate, environmental protection and energy (“CEEAG”) were adopted. They were mirrored by a corresponding set of guidelines adopted by the EFTA Surveillance Authority (“ESA”). The CEEAG widens the scope for “green” aid going forward.

1. Competition law

1.1 Antitrust – A good year for the NCA, record-breaking fines announced and follow-on lawsuits ongoing

1.1.1 The Supreme Court: Publishers collective boycott is an object restriction

The Supreme Court of Norway upheld the NCA’s finding that the collective boycott of the distributor Interpress, and corresponding information exchange, by four publishers was a restriction of competition by object. The publishers own the distributor Bladcentralen; Interpress’ only competitor in the mass market segment.

The Supreme Court relied on the two-step analysis proposed by Advocate General Bobek in his opinion in case C-228/18 Budapest Bank and held that the boycott clearly had an anti-competitive nature. The legal or economic context did not alter this conclusion. The total fines amounted to NOK 31.2 million (MEUR 3.1).

1.1.2 Record-breaking fine of MNOK 788 for novel abuse in the telecom market

Gulating Court of Appeal upheld the NCA’s 2018 decision fining incumbent telecom operator Telenor NOK 788 million (MEUR 78). Like the NCA, the Court of Appeal found that Telenor abused its dominant position by disincentivising the expansion of the third mobile network in Norway by introducing a two-part tariff for national roaming. Telenor’s argument that post-infringement developments showed no signs of negative effects in the market, was dismissed by the Court.

The abuse related to the national roaming agreement between Telenor and Network Norway (NwN), the third mobile network operator in Norway which at the time only had partial coverage. In 2010, Telenor introduced a fixed periodic fee based on NwN’s number of subscribers while the variable traffic fees were reduced. This allegedly weakened NwN’s incentives to expand its own mobile network as the savings from moving subscribers’ “home” were reduced.

Telenor’s appeal to the Supreme Court was rejected. The high-profile case has therefore finally been concluded, almost a decade after the NCA and ESA launched a joint dawn raid in 2012. ESA fined Telenor MEUR 112 in 2020 for a separate infringement. The decision is appealed to the EFTA Court, where the judgement is pending.

1.1.3 Market sharing cartel fine of NOK 1,233 million (121 MEUR) upheld

In the residential alarm systems market, the CAT upheld the NCA’s 2020 decision to impose a fine of MNOK 766 (MEUR 76) on Verisure for market sharing collusion with major rival Sector Alarm. The companies had agreed that the respective door-to-door salesforces should avoid targeting the rival’s existing customers.

Prior to fining Verisure, the NCA had fined Sector Alarm for the infringement in a separate decision. Verisure alleged that in a situation in which one of only two cartel participants had already been found guilty, the NCA had violated the presumption of innocence when it later found Verisure guilty.

The CAT found that the NCA had infringed both domestic procedural rules and the presumption of innocence. However, the CAT, by reference to its authority to examine all aspects of the decision, concluded that Verisure had committed the infringement and held that the procedural errors therefore were corrected. Verisure did not appeal. The decision is therefore legally binding.

1.1.4 Follow-on lawsuits – an expected trend

Following the decision in the home alarm market, a class action claim for damages on behalf of over 400,000 customers has been initiated. This is the first time consumers seek a follow-on class action lawsuit in an antitrust case in Norway.

In another follow-on lawsuit, the Norwegian postal operator Posten Norge claims damages in response to the European Commission’s truck cartel decision. The procedure is at a preliminary stage. Norwegian courts have issued two procedural rulings. Firstly, the Supreme Court concluded that the case could be handled by Norwegian courts even though no Norwegian entity was directly involved in the infringement. Secondly, the Court of Appeal gave Posten access to the Statement of Objections.

1.1.5 NCA continues to prosecute cases involving exchange of information and price signalling – sensational fine indicated in grocery market

The NCA has in recent years focused on cases involving information exchange and market transparency. The NCA regularly considers the infringements as object restrictions, also in cases not directly related to exchanges of future prices or intentions. None of the cases involved direct exchange of information between the parties but rather alleged increased transparency.

The most prominent case is the December 2020 Statement of Objections to the grocery chains NorgesGruppen, REMA 1000 and Coop Norge, indicating record high fines of NOK 21 billion (EUR 2.1 billion) in total. The calculated fines were NOK 150 billion (EUR 14.9 billion) in total before being reduced due to the maximum amount (10% of the annual turnover). If upheld in a final decision, the fines would have qualified for second place on the European Commission’s list of highest cartel fines, had it been a Commission fine.

In the case against the grocery chains, the parties are accused of colluding through an agreement to not hinder each other from observing actual shelf prices. The case does not concern direct information exchange or future prices or intentions. The NCA alleges that the conduct has an anti-competitive object and effect by facilitating price coordination. The grocery chains informed the NCA about the agreement when it was implemented.

In a new case against Norwegian publishers, the NCA has indicated total fines of MNOK 502 (MEUR 50). The case relates to sharing of information on fixed prices and dates of future publications through an online portal, where customers (e.g. bookstores and libraries) and all publishers have access. The NCA alleges that the conduct has an anti-competitive object by facilitating price coordination.

Further, the NCA is investigating an unknown business association for information exchange in connection with COVID‑19. Another investigation in the health sector where dawn raids were conducted by the NCA during the summer of 2021 is also related to information exchange.

1.1.6 NCA communicates first criminal case following breach of competition rules in 20 years

During the fall, the NCA revealed that they have reported an individual to the public prosecutor’s office for an alleged breach of the Competition Act in an undisclosed matter. If the Prosecuting Authority decides to initiate criminal proceedings, the case may result in the first criminal sanctions on individuals under the current Competition Act, which has been in force since 2004. Individuals have been fined prior to 2004, but prison sentences have never been imposed. Under the current Competition Act, criminal sanctions for individuals have largely been regarded as a dormant tool.

1.1.7 The NCA has published draft guidelines on price discrimination

In November 2019, the NCA published a study of input price differences in the Norwegian grocery market, showing that the leading grocery chain NorgesGruppen systematically had significantly lower input prices from several large suppliers. At the same time, the NCA launched dawn raids against NorgesGruppen and two suppliers, Orkla and Mondelez. On 16 June 2021, the NCA announced that it had closed its investigation. Despite the significant differences in input prices, the NCA found no breaches of competition law. The NCA subsequently published draft guidelines on price discrimination. The guidelines are expected to be adopted in 2022.

1.2 Merger control – focus on closeness of competition and innovation

1.2.1 Swift clearance process despite record number of notifications in 2021

In 2021, the NCA handled a record number of merger notifications, and handed down one prohibition decision, one conditional clearance, and one notification was withdrawn after the NCA issued its Statement of Objections. Further, the CAT upheld the NCA’s decision in an appeal case over the NCA’s prohibition decision. Despite an increase in notifications with about 50% from the normal level, the NCA managed to uphold the effective handling of non-complicated matters, with an average handling time of 8.3 working days for cases under the simplified procedure (75% of the notifications). Most of these cases are notified without pre-notification contact.

The NCA has received a setback so far in 2022, where two previous prohibition decisions were annulled in the CAT and the Court of Appeals, respectively:

1.2.2 Gulating Court of Appeal reverses NCA and CAT decisions to block Schibsted acquisition

In late 2019, the Norwegian based media house Schibsted acquired Nettbil. The acquisition was below the thresholds for mandatory notification. The transaction was implemented prior to the NCA ordering a merger notification in March 2020. In November 2020, the NCA prohibited the transaction. While Schibsted runs the leading online classified site for used cars in Norway, Nettbil was established in 2017, offering an innovative online solution where it acted as an intermediary for the sale of used cars. A crucial point in the NCA’s decision is that Nettbil without the transaction would develop into more important competitor in the second-hand market.

Schibsted appealed the decision to the CAT, which upheld the NCA decision in May 2021. Schibsted again appealed the prohibition to Gulating Court of Appeals. In their judgement of 23 March 2022, the court annulled the prohibition. In Norway, the CAT and the courts may carry out a full review of the case. This was the first merger decision ever handled by Norwegian courts. The court disagreed with the NCA and the CAT on key issues such as the market definition and the counterfactual. In particular, the court criticised the assessments of the evidence in the NCA decision. The court found that the development of Nettbil into a more important competitive force was a possible counterfactual, it concluded that this was not the most probable scenario. Further, the court concluded that both the NCA and the CAT had erred in their assessments of the evidence, in particular with respect to internal documents. Based on these assessments, the court found that the transaction would not lead to a SIEC, despite Schibsted’s significant market share in the online classifieds market. In its assessment, the court also found that the NCA and the CAT had downplayed the competition from players such as Facebook Marketplace.

The NCA has not yet clarified whether the judgement will be appealed to the Supreme Court.

1.2.3 CAT reverses the NCA’s prohibition decision in much debated bank merger

In November 2021, the NCA prohibited the market leading Norwegian bank DNB’s acquisition of rival Sbanken. Prior to the NCA’s decision, the acquisition had sparked unprecedented levels of public debate about a merger case, particularly from Sbanken’s loyal customer base.

The NCA’s prohibition decision was based on the effects in the market for distribution of mutual funds to private customers. Although the market for mutual funds was found to be moderately concentrated post-merger, with a combined market share of 30-35%, the NCA found that the parties were close competitors and that Sbanken was an important source of innovation and its presence led to competitive pricing dynamics in the market. The case can therefore be considered as a “gap case”, without finding dominance before or after the transaction.

In its decision of 16 March 2022, the NCA’s decision was overturned. While the CAT acknowledged that DNB and Sbanken are close competitors, it found that several other market players remain close competitors to DNB and Sbanken and that these are well-positioned to replace all or most of the competitive pressure currently exerted by Sbanken. Further, the NCA had failed to establish that Sbanken significantly stands out from its competitors with regard to innovation and technological development.

The NCA cannot appeal the CAT’s decision. It is therefore final. Further information is available in our newsletter here.

2. State aid – green focus and pandemic remedies

2.1.1 Second year of the pandemic has led to a huge increase in state aid decisions

As elsewhere in the world, the restrictions imposed as a result of the COVID-19 pandemic has brought with it a significant number of state aid measures aimed at alleviating losses and remedying the serious disturbance in the economy. In 2021, 39 state aid decisions concerning Norwegian measures were taken by ESA, of which 28 dealt with COVID-19 measures. ESA applied the European Commission’s Temporary Framework aimed at increasing the flexibility for EEA-states to use state aid as a tool to combat the economic fallout. The Temporary Framework is set to remain in effect until 30 June 2022.

The number of notified non-COVID-19 cases remained at the same level as previous years. Highlights from 2021 include; decision 276/21/COL in which ESA approved an extension of the Norwegian regional aid scheme concerning the differentiated payroll tax, the scheme no longer excludes the transport and energy sectors; and decision 288/21/COL in which ESA found that the Norwegian financing of the marine and maritime research hub Ocean Space Centre did not involve any state aid on the grounds that the research centre shall be used almost exclusively for non-economic purposes. The latter decision is a rare case of the application of the 2014 state aid guidelines/framework on R&D&I and is an instructive example on how to analyse the financing of research infrastructure subject to mixed use.

2.1.2 From EEAG to CEEAG – new guidelines for climate, energy and environmental aid

In 2021, the EU Commission introduced the Guidelines on state aid for climate, environmental protection and energy. They entered into force on 27 January 2022. The guidelines allow EU Member States to use state aid as a “green tool” to reach objectives such as a circular economy, biodiversity, building energy efficiency and decarbonization of the economy. The guidelines represent an important tool in relation to the EU’s Green Deal. On 9 February 2022, equivalent guidelines were adopted by ESA for the assessment of such aid from the EFTA states, including Norway.

The new guidelines allow Member States to cover 100% of the funding gap for certain green projects, especially when state aid is granted as a result of public tenders. The guidelines also allow for various kinds of operating aid and set out new rules for carbon contracts for difference, in which the state covers the difference in cost between the use of fossil fuels and zero-emission fuels.

Further information is available in our newsletter (Norwegian only) here.

2.1.3 New state aid procedural law – an update that was long overdue

The parliament has adopted a new act on state aid procedures. The act will enter into force after decision by the King in Council (Government). The act is procedural in nature and does not amend the substantive rules on state aid, which will still be exclusively regulated by the EEA-agreement.

The act represents an update and modernisation of the Norwegian State Aid act of 1992, which has not been subject to a thorough revision since its inception. The proposed new act introduces clearer provisions regulating the obligation for public bodies to notify state aid schemes to ESA, and to not implement these schemes until ESA has issued a decision.

The proposal further clarifies that the statute of limitations for recovery claims from national authorities concerning unlawfully granted state aid follows the Norwegian act on the limitation period for claims. Thus, it sets out a 3-year limitation period which is substantially shorter than the 10-year limitation period that applies to recovery decisions taken by ESA.

3. Public procurement – increased number of cases – many won by the claimant

The trend of increasing litigation within the field of public procurement has continued in 2021. Public procurement cases involve: (i) interim injunction cases to stop the signing of a contract, (ii) control of the fines imposed by the Norwegian Complaints Board for Public Procurement and (iii) damage claims.

In 2021, over 20 interim injunction cases were published by the Norwegian law registry Lovdata.no, of which nearly half were decided in favour of the claimant. Given that the registry does not publish all cases, there is reason to believe that the actual number of cases is substantially higher.

An increasing number of cases are also brought before the judicial system following the Norwegian Complaints Board’s decisions in cases where public authorities are fined for concluding contracts directly without prior notification. In these circumstances, the Complaints Board may issue fines within a range up to 15% of the contract value. However, the courts are often reluctant to overrule the Complaints Board’s decisions, particularly with respect to the level of the fine. The most prominent case includes the Borgarting Court of Appeal verdict concerning successive and regular purchases by two Norwegian counties of interpreting services on 15 December 2021. The Court found that the contracts, which related to different languages, but were otherwise identical and had been concluded with the same interpretation service company, constituted “regular acquisitions of similar contracts”. The contracts, which individually did not meet the thresholds for mandatory public tenders, but collectively did so, should therefore have been acquired under the procedure for public tenders. The court found that the failure to issue a public tender was grossly negligent.

The Court however dismissed the part of the appeal related to the level of fine calculated by the Complaints Board on the grounds that the Board had followed its own practice in setting the fine, and that the practice appeared to be reasonable and proportionate.

Increased contract values have increased the incentives of losing parties to the competition to sue for damage claims. There are limited downsides to suing for damages and often a significant potential upside. Further, the way the Norwegian courts have interpreted the requirements for basis of liability and causal connection in procurement cases, have resulted in a state of law where it is possible to claim damages for both expectation interest and reliance loss. Combined with ambiguous guidance from the Complaints Board, we have therefore seen a record high numbers of claims for expectation interest in 2021.