Asset Management – Private Equity – M&A | Weathering The 2025 Exit Drought: How Continuation Funds Could Provide a Solution for PE Firms

From Exit Upswing In 2024 To 2025’s Exit Drought

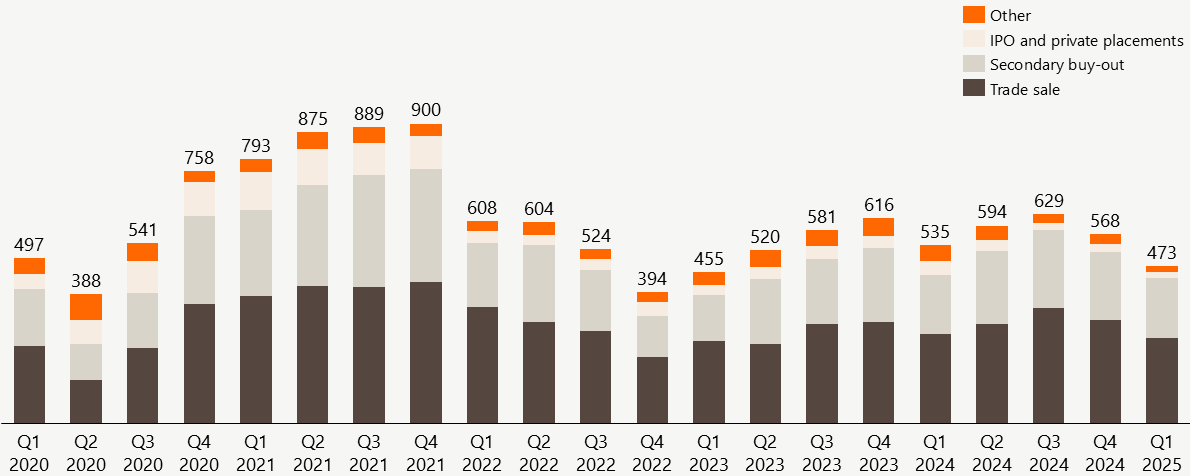

Towards the end of 2024 an uptick in private equity-backed exit activity could be observed, with annual exit volumes being up 5% year-on-year compared to the year before, and the average holding period for a buyout fund portfolio company marginally going down compared to the 10-year high of 6.2 years observed in 2023. One quarter into 2025, the picture looks vastly different.

With a total number of private equity-backed of 473, corresponding to a value of c. 81 USD billion, the numbers have not been lower on either volume or value in two years, since Q1 2023.

Figure 1: Private equity-backed exits by type, Q1 2020-Q1 2025, # of exits

Source: S&P Global Market Intelligence, Prequin Pro

Similar development is observed in the Norwegian and overall Nordic private equity markets. Current market uncertainty, including the US tariffs, is the main driver for the changed sentiment. It has led to decreased consumer and business confidence, and combined with the current interest rate levels, in turn caution and reduced activity levels. While there is still opportunity for high-quality investments, investors are expected to be more focused on companies and sectors that have demonstrated resilience in the past, with strong fundamentals and a stable growth-outlook going forward.

High-Stakes Consequences: Reduced Exitability Impacts PE Lifecycle

Reduced exit activity affects each stage of the investment lifecycle. Prolonged holding periods squeeze fundraising by limiting LP liquidity—GPs have returned less capital than they’ve drawn in five of the last six years—and can raise concerns over returns. Still, GPs with a clear strategy and solid track record continue to successfully raise capital amid market uncertainty.

Secondly, reduced exit pathways weaken deal flow as valuation gaps widen between sellers and buyers, compounded by tougher financing conditions.

Finally, PE firms must focus on operational improvements rather than relying on multiple arbitrage or financial engineering. Proving stronger fundamentals—such as enhanced EBITDA—remains crucial for a successful exit.

Chartering The Way Forward: Navigating Ordinary Exits In Today’s Environment

PE firms seeking a traditional exit despite the recent turmoil must prepare thoroughly, as heightened scrutiny is likely in today’s market. Meticulous legal and compliance preparation strengthens the likelihood of successful transactions in challenging conditions. Regulatory authorities emphasize compliance and ESG, and buyers are increasingly cautious, making robust governance, legal readiness, and transparent ESG disclosures essential.

Buyers will conduct thorough due diligence on legal, financial, and ESG profiles. New regulations spotlight robust compliance in areas like data protection and supply chain governance. Sellers seeking top valuation should implement and test compliance systems. Ensure intellectual property is protected and agreements are enforceable. Cross-border deals require extra attention to jurisdiction-specific mandates. Basic housekeeping is a hygiene factor, e.g., up-to-date corporate documentation (bylaws, shareholder records, and key contracts) to remove ambiguities.

In the current climate, environmental considerations significantly shape transaction outcomes. A structured approach to the target’s ESG profile and compliance policies pays off, given buyers’ rising focus on corporate social responsibility, sustainability reporting, and the risk of climate-related litigation. Thorough environmental impact assessments, robust health and safety measures, and compliance with regional standards bolster negotiations. Meanwhile, if personal data is used commercially, ensure strict adherence to data privacy regulations, such as GDPR, to avoid compliance pitfalls.

3 Practical Tips To Enhance Chance Of A Successful Exit Process

- Conduct vendor due diligence and run a tight process. to identify and address red flags before going to market. This reassures buyers and streamlines transactions. Maintain clear communication among in-house teams, external counsel, and management for strong alignment on strategy and timelines. Clarify capital structure and shareholder agreements early to prevent exit complications.

- Transparent corporate governance, from board composition to conflict-of-interest policies, curbs last-minute price adjustments and negotiation delays.

- Robust compliance, precise documentation, and strong governance drive value and mitigate external risks. These measures reduce surprises, accelerate negotiations, and secure favorable deal terms. Early, transparent action builds buyer trust—vital for a timely, profitable exit.

Exploring Alternative Exit Avenues: Secondary Transactions & Continuation Funds

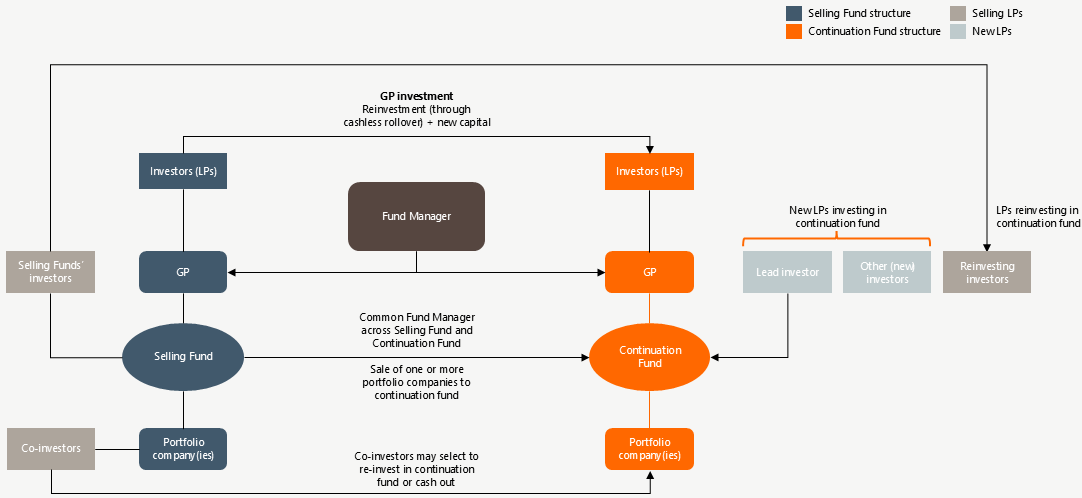

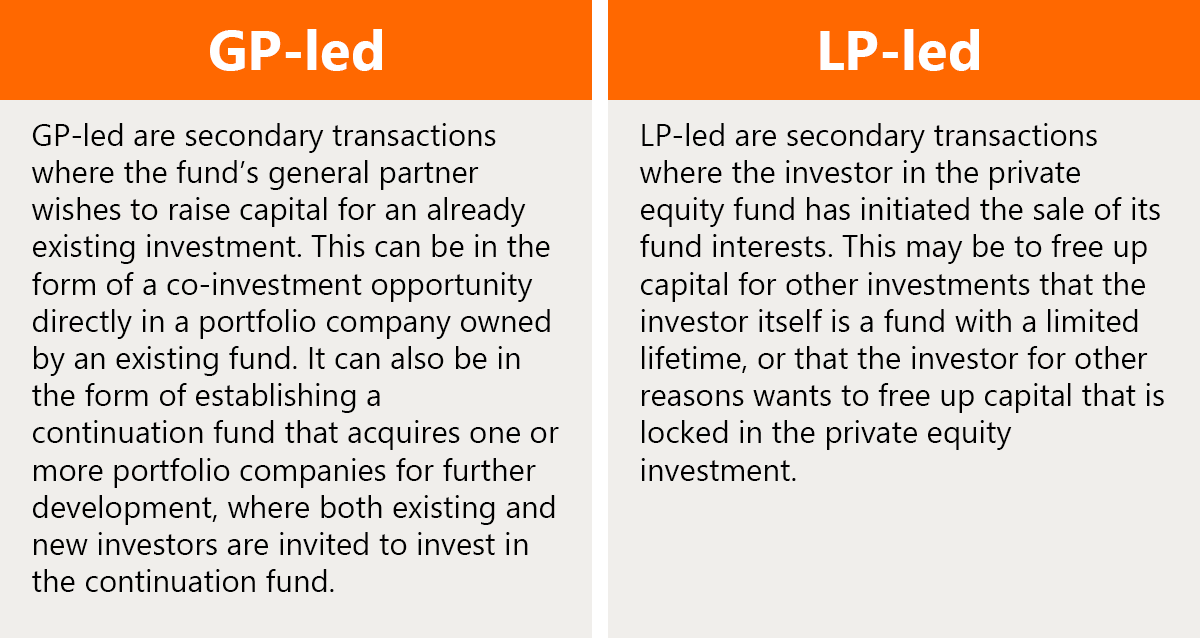

As an alternative to a traditional exit route, PE firms are increasingly exploring other ways to return capital to investors and manage the fund lifecycle without fully exiting their portfolio companies. One such method is a secondary transaction, which may be initiated by the GP or LP. In periods of market volatility or when stock markets are in decline, both LP- and GP-led secondary transactions tend to rise. In the following we focus on GP-led secondary transactions, in the form of continuation funds. (For our perspective on LP -led transactions, see our newsletter here.)

With fewer exit options—due to reduced buyer appetite and less favourable market conditions for IPOs—GPs increasingly seek alternative pathways, such as setting up continuation funds financed by new capital, typically involving both existing and new LPs. These funds allow GPs to avoid unfavorable sales, weather challenging market conditions, and position the portfolio asset for a more advantageous future exit, all while returning capital to investors.

We observe similar trends regarding establishment of continuation funds in Norway. Since 2020 we have assisted asset managers with the establishment of five continuation funds. In addition, we have assisted LPs with six investments in continuation funds.

Why Continuation Funds Appeal to GPs and LPs Alike

Continuation funds present an appealing option for both GPs and LPs, offering more flexibility and control in uncertain market environments. For GPs, these structures enable the retention of high-potential assets for a longer period, providing additional time to implement strategic initiatives that can increase a portfolio company’s profitability and market value. By avoiding a forced sale in a potentially unfavorable environment, GPs preserve upside potential and maintain influence over key operational decisions. Additionally, the Limited Partnership Agreement (LPA) and other fund documents outline the terms for GPs when extending fund terms or pursuing alternative exit structures. By staying within these contractual limits and ensuring alignment with the overall investment strategy, continuation funds serve as a valuable tool to preserve and potentially enhance returns for all parties. As a result, both parties can benefit from enhanced alignment of interests, clearer long-term strategies, and the opportunity to capture additional value that might otherwise be lost in a rushed or suboptimal exit.

Illustration – The structure of a Continuation Fund

From an LP’s perspective, continuation funds allow investors to remain invested in promising companies, avoiding the extra costs or administrative hurdles tied to reinvesting capital through the secondary market. Moreover, they gain the ability to adjust how much they roll over, meaning they can tailor their exposure levels based on their own risk tolerance, liquidity needs, and market outlook.

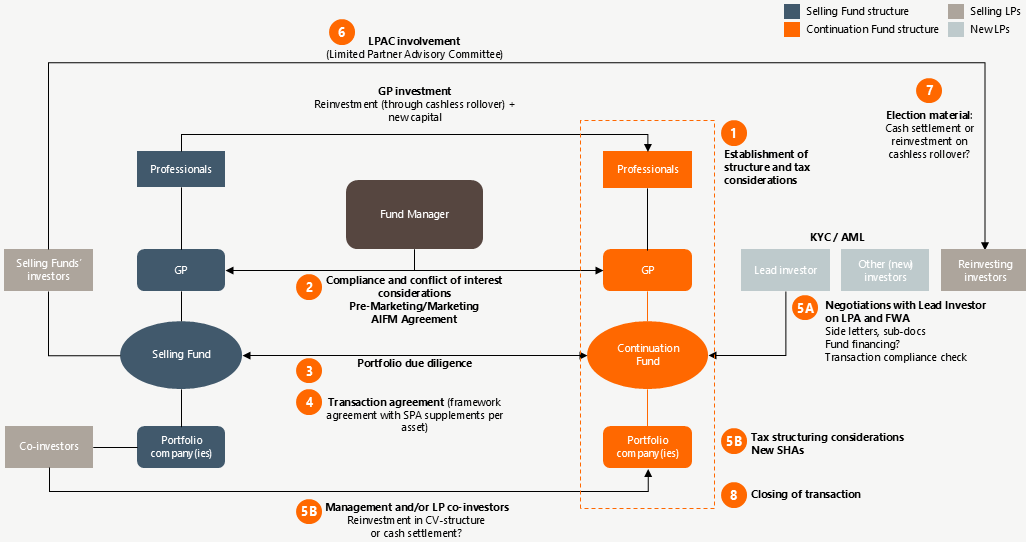

8 Step Guide to Setting Up a Continuation Fund

Setting up a CV requires balancing the interests of multiple stakeholders while ensuring trust among both existing and new investors. For GPs, a structured and transparent process—one that thoroughly documents how potential conflicts of interest are assessed and addressed—is imperative. A thorough approach enables GPs to effectively manage the interests of LPs who are exiting, LPs who are rolling over, and incoming LPs, and the GPs own interests, while upholding their fiduciary responsibilities in a trustworthy manner. Setting up a CV implies raising a fund and simultaneously doing a transaction, with the same fund manager managing both the selling fund and the new continuation fund, which raises specific issues and adds additional requirements to the rigour of the process.

Below we outline how such a process could look, and the main steps included in the process. By following these steps—supported by thorough legal, compliance, and tax advice—private equity managers can establish a continuation fund effectively and transparently.

Illustration – The process of setting up a Continuation Fund

BAHR’s View

We expect the exit market to remain challenging at least for the coming quarters, until the macro situation appears predictable. In the meantime, we observe a clear trend of increasing secondary transactions in turbulent times. Similar to what we have seen in other European and US markets, we expect the number of secondary opportunities to continue to increase in Norway in the coming period, both through the establishment of continuation funds and co-investment funds. This indicates that already at the inception of a primary fund, and when establishing a shareholders’ agreement for each portfolio investment, flexibility should be introduced to ensure that an investment can exit through a continuation fund. Accordingly, both the mandate and contractual framework should appropriately accommodate the creation of and transfer to a continuation fund in the future.

For funds wanting to pursue a clean exit despite the market challenges, we recommend early and thorough preparations that can endure increased scrutiny in potential buyers’ due diligence processes.

BAHR’s asset management group continuously assists in both sell-side preparations and secondary transactions.