BAHR Energy Insight | The Norwegian parliamentary election and the potential impact on the petroleum industry

The Norwegian parliament, known as “Stortinget”, plays a crucial role in shaping the framework for petroleum activities in Norway through its legislative powers. Material policy matters, including major development projects, are normally considered by Stortinget. Additionally, Stortinget oversees the government and public administration, maintaining a supervisory role to ensure compliance with established policies. Despite changes in Stortinget’s composition over time, the fundamental framework for Norwegian petroleum policy has remained quite stable. This stability is supported by a broad political consensus involving both sides of the political aisle on the key aspects of petroleum policy, which is vital for the petroleum industry due to its long-term investments and significant capital requirements.

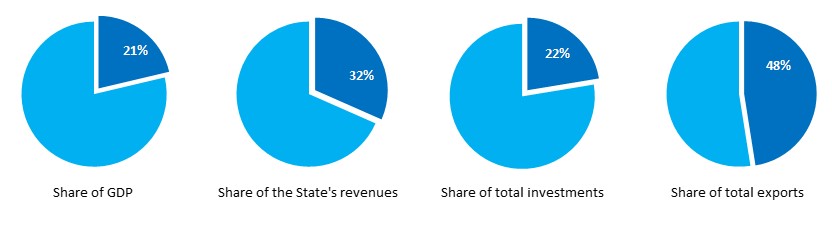

The petroleum industry is the largest and most important sector of Norway’s economy measured in terms of value, State revenues, investments and export value.

Macroeconomic indicators for the petroleum sector, 2025:[1]

BAHR has previously issued newsletters analyzing upcoming elections and their potential impact on the petroleum industry. We continuously monitor and observe the industry closely as a spectator, but also as a key advisor to several of the industry leaders. On this basis we now return with a newsletter where we assess the upcoming 2025 parliamentary election and the impact the result could have for the petroleum industry. To focus the assessment, we concentrate on the following topics which have all been part of recent public debate:

- The question of continuation or discontinuation of petroleum activities

- Policies on not awarding new production licenses to reduce petroleum production

- The 26th licensing round

- Electrification of offshore petroleum installations

- Parliament’s involvement in approving plans for development and operation (PDOs)

- Certain aspects of the petroleum tax system

Our assessment is based on the major political parties’ written policies as they are presented in their respective 2025 parliamentary election manifestos. The assessment also includes certain statements given to the media. Our ambition is not to present a complete picture of the political landscape or relevant matters for the industry, but to give a rough guide to the political parties’ perspectives on certain selected key topics and the potential impact these perspectives could have on the petroleum industry after the election in September.

Overview of the political landscape going into the election

Norway’s political system is a parliamentary democracy based on proportional representation. Norway’s political landscape features several parties with elected representatives cooperating to secure a majority in the parliament. To achieve a majority, 85 (of 169) of the representatives are necessary. Forming coalitions often entail complex negotiations and compromises, resulting in a dynamic environment where political support may end in response to disagreements concerning challenging political topics. A majority government will consist of enough representatives to have a majority in parliament. In Norway, we sometimes have minority governments, who are dependent on support from other parties to form a majority, e.g. when proposing a national budget.

Even relatively small political parties can therefore end up holding the balance of power, where they can determine the outcome of votes and leverage their position to gain influence on specific policy matters that exceed their electoral support. This may take place through negotiations to form a majority coalition government with an agreed political platform, or through providing ad hoc support to a minority government in budget or policy matters in Stortinget. Policy shifts may thus not only appear directly after the election, but e.g. in relation to national budgets.

Following the 2021 parliamentary election, Arbeiderpartiet (AP; Eng: The Labour Party) and Senterpartiet (SP; Eng: The Centre Party) formed a minority coalition government. Sosialistisk Venstreparti (SV; Eng: The Socialist Left Party), who had been in negotiations with Arbeiderpartiet and Senterpartiet following the election to form a majority government, chose to remain outside the coalition government whilst seeking to cooperate with the minority government on ad hoc matters, citing insufficient commitment from Arbeiderpartiet and Senterpartiet to address matters such as oil and gas policy, climate change and social inequality. The minority coalition government formed by Arbeiderpartiet and Senterpartiet faced several challenges that led to its eventual breakdown, with Senterpartiet withdrawing in January 2025 due to disagreements over energy policies related to the implementation of EU energy directives, and Arbeiderpartiet continuing as a single party minority government.

These shifts, and others, have created a more fragmented political landscape, while also highlighting the relevance of energy policy as one of the most important topics in Norwegian politics.

The dissolution of the minority coalition government was followed by a period of increased uncertainty, as parties reassess their positions ahead of the 2025 election. This shift reflects a broader trend in Norwegian politics, where traditional bloc alignments are becoming less rigid, and the political environment is characterized by a search for viable partnerships and choice of prime minister candidates that can secure a majority in the Norwegian Parliament.

The illustrations below show the standings as of 25th August 2025, according to the www.pollofpolls.no.[2] All references to poll results in this newsletter will be based on data from this website, presenting a calculation based on the average of several polls.

Average of national polls – Support as of 25th August 2025 compared to the 2021 parliamentary election:

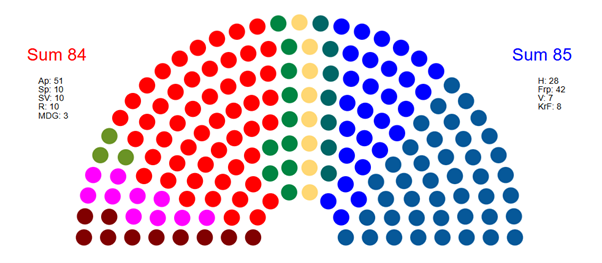

Mandate distribution as of 25th August 2025:

There are several ways to group the different parties, but they are normally placed in blocks or on a scale from left to right with some parties in the center depending on their position in key policy matters. In this publication we have for simplicity grouped political parties into one left side and one right side.

There are a few key takeaways or indications to draw from the above illustrations and the standings as of 25 August:

- The election appears to be a close race. Should the outcome of the election be as the average of the most recent polls suggest, the right side will be the largest with one mandate and will on that basis have grounds to start negotiations to form a new government. The election is however still some weeks away, and much can still change.

- Unlike 2021, where the three traditional cooperation parties on the left side (Arbeiderpartiet, Sosialistisk Venstreparti og Senterpartiet) together had a majority, support from either or both of Rødt and Miljøpartiet De Grønne may be required for a majority vote should the left side win the election. This may potentially increase such parties’ influence.

- Miljøpartiet De Grønne, Venstre and Kristelig Folkeparti are all close to the electoral threshold of 4%, which will give rights to further equalization mandates.[3] Tactical voting from each side to get such parties above the threshold to secure support for the voters’ preferred government has been a topic in public debate.

- Both Senterpartiet, Høyre and Sosialistisk Venstreparti have had a substantial downturn in support since the 2021 election, whilst Fremskrittspartiet have had a substantial increase.

The “left side” of Norwegian politics

The key parties on the left side in Norwegian politics prior to the 2021 election were Arbeiderpartiet, Senterpartiet and Sosialistisk Venstreparti. Arbeiderpartiet currently holds office alone. Following Senterpartiet’s recent exit from the government and the return of Jens Stoltenberg to Norwegian politics, Arbeiderpartiet experienced a marked increase in popularity and is now the largest party, with an estimated 26.9% of the expected votes. It will be interesting to see how this will influence the election process and the result. Meanwhile, Senterpartiet, after securing 13.5% of the votes in 2021, has dropped to only 6.2% in August 2025. Sosialistisk Venstreparti is currently polling at 6.3%, which is down with 1.4% since the 2021-election.

As for oil and gas, Arbeiderpartiet favors developing, rather than discontinuing activity on the NCS whilst respecting our climate obligations. At the same time, there are differing views within the left side. Whilst Senterpartiet wants to continue activity and open new areas for exploration through new license rounds, Sosialistisk Venstreparti seeks to phase out Norway’s oil and gas production inter alia by halting exploration and refraining from issuing new petroleum licenses.

The national political landscape on the left side also includes parties such as Miljøpartiet De Grønne (MDG; Eng: The Green Party) and Rødt (R; Eng: The Red Party). While Miljøpartiet De Grønne continues to struggle with meeting the 4% electoral threshold (polling at 3.9%), Rødt has seen a marked increase in support since the last election (polling at 6.2%) and has for the first time signaled a willingness to engage in a formal government coalition.

Arbeiderpartiet has recently stated that they envision to continue to govern alone if the election results in a majority for the left side, even though they seem to be dependent on support from at least Sosialistisk Venstreparti and Senterpartiet.[4] Arbeiderpartiet has further acknowledged that although they do not perceive it as natural to form a government with Rødt or Miljøpartiet De Grønne, future ad hoc cooperation with Rødt and Miljøpartiet de Grønne may become a viable option. Arbeiderpartiet does not wish to take a formal standing on what this cooperation will entail until after the election.[5]

Whilst Miljøpartiet De Grønne advocates an immediate halt to further exploration of oil and gas resources and aims to phase out the petroleum industry on the NCS by 2040, Rødt not only calls for prohibiting any new license awards and strengthening democratic oversight of the petroleum industry but also seeks to terminate approved projects that have not yet commenced.

The “right side” of Norwegian politics

The right side of Norwegian politics consists of Høyre (H; Eng: the Conservative Party), Fremskrittspartiet (FRP; the Progress Party), Venstre (V; Eng: The Liberal Party) and Kristelig Folkeparti (KRF; Eng: The Christian Democratic Party). Historically these parties have collaborated to form governments or secure majority; and with shifting coalitions formed the government between 2013-2021. Høyre has traditionally been leading the block due to its larger voter base. However recently, Fremskrittspartiet has experienced a substantial increase in voter support, now estimated at 21.8%, which is a 10.2% rise since 2021, making it the largest party within the right side and the second largest party in Norway. Høyre is currently polling at 15.2%, which is a 5.2% drop since the 2021 election, and an even larger drop since forming government in Norway in 2013-2021. Høyre’s current downturn may influence the political dynamics and choice of prime minister candidate should the right side gain majority.

In light of this changing dynamic, considerable uncertainty also surrounds the formation of a future government for the right side as support from all four parties is likely necessary to gain a parliamentary majority. Fremskrittspartiet has stated that it wishes to govern exclusively with Høyre,[6] which leaves the role of the other two parties, Venstre and Kristelig Folkeparti, more uncertain. The uncertainty is further heightened by the fact that both Venstre and Kristelig Folkeparti are above, but close to the 4% threshold to receive additional equalization mandates, which further obscures the right side’s chances of forming the next government. Furthermore, depending on the election outcome, it remains to be seen who will be put forward as the candidate for prime minister. While Høyre historically has held this position due to its larger voter base, Fremskrittspartiet’s growing popularity has introduced debate about leadership within a potential coalition.

Fremskrittspartiet remains a firm advocate of the petroleum industry, calling for increased activity on the NCS, including in northern regions. Similar to the left side, however, the right side’s stance on oil and gas is not entirely aligned. Whilst Høyre endorses continued development of the sector within the framework of Norway’s climate commitments, as well as exploration of new areas, Venstre takes a contrasting view that favours halting further exploration and ending the award of new licences. Positioned more centrally is Kristelig Folkeparti, which proposes restricting any future license awards to expansions or extensions of existing operations in mature areas.

Assessment of certain topics: The overall continuation of the petroleum industry

The Paris Agreement Article 4 (2) decides that the Parties to the Agreement “shall prepare, communicate and maintain successive nationally determined contributions that it intends to achieve”. This policy is implemented in Norwegian legislation through the Climate Act which sets out in Article 3 that the target should be that emission of greenhouse gasses should be reduced by at least 55% within 2030, compared to the emissions in 1990. Furthermore, in June 2025, a new climate target for 2035 was introduced in Article 4 of the Climate Act, pointing to a reduction of 70–75% from 1990 levels. Meanwhile, the European Commission has proposed achieving a 90% reduction in emissions by 2040. Lastly, Article 5 of the Climate Act envisages Norway becoming a low-carbon nation by 2050.

Against this backdrop, a question arises: How is continuing the petroleum industry and securing energy for Europe compatible with achieving the targets set out in the Paris Agreement and the Climate Act?

Generally, Arbeiderpartiet, Fremskrittspartiet and Høyre are all in favor of continuing the petroleum industry on the NCS. However, while Arbeiderpartiet and Høyre supported the recent new ambitious climate target of reducing emissions by 70-75% by 2035 compared to 1990 levels, Fremskrittspartiet is critical of Norway’s climate goals under the Paris Agreement, viewing them as unrealistic and costly.

A cornerstone in Fremskrittspartiet’s position on the petroleum industry is its recognition of the sector as Norway’s largest and most important industry. The party’s election manifesto states that it will facilitate increased investment in research and development within the industry, ensuring that the oil adventure on the NCS can continue into the foreseeable future. Building on their approach to the petroleum sector, Fremskrittspartiet also advocate for conducting impact assessments in Northern Norway to facilitate petroleum activities.

Høyre’s stance is more aligned with Arbeiderpartiet’s stance. However, one can discern that issues relating to the petroleum industry may be particularly challenging for Arbeiderpartiet. One might say that the party, more so than Høyre, must balance two competing considerations pulling in opposite directions. Many employees in the sector form a core part of Arbeiderpartiet’s voter base, which is in turn linked to important support from the Workers Union (LO). Consequently, Arbeiderpartiet is cautious about adopting policies that could be perceived as undermining or casting doubt on these workers’ role in building the Norwegian welfare state. According to Arbeiderpartiet’s political manifesto, its overarching objective is to further develop the petroleum industry rather than discontinue it.[7] There are also strong forces against the petroleum industry in Arbeiderpartiet’s youth organization (AUF; Eng: the Youth Labour Party), who in their separate manifesto argues in favor of not awarding new licences on the NCS and phasing out the petroleum industry. Although this policy is not shared by Arbeiderpartiet, AUF has a track-record of putting pressure on its parent party, for instance regarding the issue of petroleum activities in northern Norway.

In addition to Arbeiderpartiet, Fremskrittspartiet and Høyre, Senterpartiet, which is known for its strong commitment rural districts and to safeguarding the Norwegian workforce, remains a steadfast proponent of the nation’s petroleum industry on the NCS. Kristelig Folkeparti likewise supports continued petroleum activities. Important aspects in such position is the importance of the petroleum sector for Norwegian welfare, the relative low carbon footprint compared to certain other producing countries and the key role of Norway as a stable energy supplier in a Europe facing war and uncertainty.

Altogether, these parties represent a substantial political majority of about ¾ of all votes and are in favor of continuing petroleum activities (according to the average of the polls included in pollofpolls as of 25 August 2025, as referenced above). The overall direction on continuing petroleum activities therefore seems steadfast. However, as views differentiate significantly within the political parties on both the left and right side and as other parties would expect some influence in their key matters to support a government, the outcome of more detailed policy matters will likely be important to monitor. For example, if the left side should achieve a majority, the latest polls suggest that may involve the support of not only Arbeiderpartiet, Senterpartiet and Sosialistisk Venstreparti (who together had a majority in 2021), but also Rødt and Miljøpartiet De Grønne who hold contrasting views as their primary policies. Similarly, on the right side, support from Venstre will likely be required to achieve a majority.

In our opinion, the combined backing from parties such as Arbeiderpartiet, Fremskrittspartiet, Høyre, and Senterpartiet, provides a substantial and firm foundation for continued petroleum operations on the NCS. The questions seem more to be on the way forward for more specific policy matters, some of which are discussed below.

Policies on not awarding new licenses to reduce petroleum production, including the question on the 26th licensing round

Pursuant to the Norwegian Petroleum Act, the Norwegian State has the proprietary right to subsea petroleum deposits and the exclusive right to resource management. A production licence from the State is required to be able to conduct petroleum activities. For the petroleum industry to continue, the licensees are dependent on new acreage to be opened for petroleum activities and licensing rounds to be held awarding the licensees the right to search for petroleum.

On the NCS, there are two types of licensing rounds where the government grants E&P companies the rights to explore for petroleum. Those are the annual awards in predefined areas (APA) for mature parts where the knowledge is highest and numbered licensing rounds in other areas.

As a way of discontinuing or effectively halting Norwegian petroleum production, several smaller parties are in favor of not awarding any new production licences.

The strongest advocates for this policy are notably Miljøpartiet De Grønne, Sosialistisk Venstreparti, Venstre and Rødt, all of which seeks to halt exploration for new oil and gas discoveries on the NCS and refrain from awarding new licences. Kristelig Folkeparti stance is more cautious, and its election manifesto supports further licences, provided that no petroleum activity takes place in fragile areas.

As set out above, the policy of phasing-out the Norwegian petroleum industry is not supported by the largest political parties. The above overview, however, illustrates that there are advocates for such discontinuation policy within both sides of the political aisle. One can therefore perceive that the question will be subject to negotiations for any of the sides looking to form an administration following the election.

The 26th licensing round was initially launched in 2020, including 136 blocks, primarily in the Barents Sea and the Norwegian Sea. However, following the 2021 election, Sosialistisk Venstreparti successfully negotiated with the government to halt the 26th licensing round during the current parliamentary period (the APA rounds were continued).

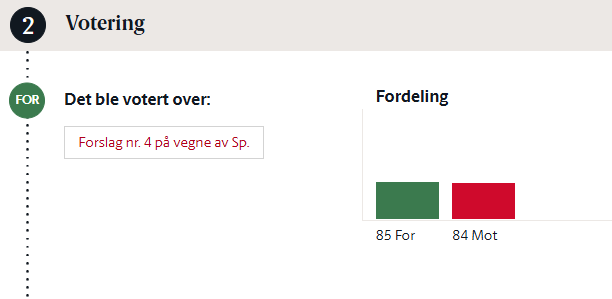

On May 6, 2025, the Norwegian Parliament voted on a proposal by Senterpartiet to begin preparatory work for the 26th licensing round, with the intention of announcing it in early 2026 (which is after the current parliamentary period). The proposal narrowly passed with 85 votes in favour and 84 against. In favour of the proposal were Fremskrittspartiet, Høyre and Senterpartiet, while Arbeiderpartiet, Sosialistisk Venstreparti, Rødt, Venstre, Miljøpartiet De Grønne and Kristelig Folkeparti opposed the proposal.

Voting overview:[8]

In the aftermath of this parliamentary vote, Sosialistisk Venstreparti openly criticized Senterpartiet for what it perceived as a breach of their 2021 agreement.[9] However, Senterpartiet maintains that they have not violated the agreement, asserting that the current government term concludes in the autumn of 2025, and that the licensing round in question will not be announced until 2026. The reason for Arbeiderpartiet, who supports continued activity, voting against is not clear, but part of the reason was maybe to not risk facing such controversy with Senterpartiet and to push the matter to after the election. In the debate, Minister of Energy, Terje Aasland, stated that he doubted whether six months would not be necessary to prepare for a 2026 licensing round.

On 8 August 2025, the government followed up Stortingets’ decision and stated that they have started the work for announcing the 26th licensing round by initiating a nomination process towards the NCS licensees.

The razor-thin margin in the vote is an illustration and highlights just how significantly the outcome of key policies for the industry could swing considering both the future election results and the following negotiations to form a majority supported government. We assume the continuation of the process for the 26th licensing round will be a topic to monitor going forward.

Electrification of facilities linked to petroleum activities

As mentioned above, Norway is committed by the terms agreed in the Paris Agreement as implemented by the Climate Act. By reducing emissions from the petroleum industry through measures such as electrifying the NCS, Norway is strengthening its ability to meet the ambitious climate targets set out in the Climate Act. For many, electrification is thus regarded as a key step in ensuring that Norway fulfills its climate targets. At the same time, the debate has intensified due to, for example, the consequences the electrification of the NCS, and especially electrification from shore, may have on electricity prices and grid capacity. The implementation therefore remains a subject of political debate.

Compared to the 2021-election, there is now seemingly greater hesitance concerning electrification of the NCS in public debate and in the political parties’ election manifestos. Much like in 2021, Fremskrittspartiet seeks to discontinue further electrification of the NCS and also argues to stop electrification-projects that are awarded but not yet initiated. This position has, for different reasons, now seemingly been endorsed by Rødt, Miljøpartiet De Grønne, Senterpartiet and Kristelig Folkeparti, which has rendered the issue subject to more extensive debate now compared to 2021. Conversely, Arbeiderpartiet, Høyre, Sosialistisk Venstreparti and Venstre regard electrification as one of several measures for achieving the goals set forth in the Paris Agreement. Several parties highlight use of offshore wind to not negatively affect the onshore electricity prices and infrastructure as well as requirements for supplement of replacement power if the NCS is further electrified. We assume such discussions will be important to follow also following the election.

The recent developments surrounding Melkøya exemplify the ongoing debates regarding electrification. Extensive discussions have led to numerous proposals, culminating on May 6, 2025, in a narrowly decided vote (again, 85 in favor versus 84 against) to proceed with the electrification process. This outcome underscores the polarizing nature of the issue and the challenges of reconciling Norway’s petroleum activities with its climate obligations disagreements that continue to fuel debate in Stortinget.

Parliament’s involvement in approving plans for development and operation (PDO)

The Norwegian parliament’s current policy is that projects on the NCS valued below NOK 15 billion can be decided by the government. Projects valued above NOK 15 billion must also be presented to and approved by the parliament. In the years prior to 2021-2022, the same threshold was NOK 20 billion, but it was lowered to 15 to increase parliamentary control.

Rødt explicitly state in its political manifesto that they want to further lower this threshold and increase parliamentary scrutiny. Recently, the Fram Sør project has become a focal point of debate in relation to the current NOK 15 billion threshold.

The Fram Sør project constitutes of several deposits representing a combined investment of NOK 21 billion presented in one PDO. The Ministry of Energy maintains that the threshold for projects exceeding NOK 15 billion is not tied to the actual PDO document, but rather to the specific oil and gas deposits being developed. Since the project spans four distinct deposits, the investment for each deposit remains below the NOK 15 billion limit, thereby permitting the government to approve the venture without parliamentary intervention.

This interpretation has been criticized by Sosialistisk Venstreparti, which contends that the threshold for parliamentary scrutiny should be determined by the overall PDO cost and therefore argues that the Fram Sør project should be submitted for parliamentary review. The debate about the NOK 15 billion threshold and Stortinget’s involvement in approving major projects such as Fram Sør is part of a broader political discussion about how Norway should balance economic development with environmental considerations and democratic control. With the upcoming election, this could potentially become an important topic that affects party positions and negotiations following the election.

As the shelf matures potentially leading to further joint developments of smaller deposits, such NOK 15 billion monetary threshold and its interpretation may be of increased importance in coming years. It will be interesting to see if the threshold and its practical interpretation for multiple coordinated developments like Fram Sør will be subject to negotiations following the election.

The petroleum tax system

The petroleum resources belong to the Norwegian State and the State secures its revenues through taxation, direct participation in certain licences through Petoro and as a majority shareholder in Equinor. Additionally, fees on emission of CO2 and NOX are levied. The petroleum industry’s total tax payments to the state are estimated to be approximately NOK 336 billion in 2025.

Following the 2021-election, the petroleum tax system was restructured to a cash flow-based model. Please see our newsletter from the implementation of the new petroleum tax system (available HERE) for further details. There is seemingly a majority for keeping the current petroleum tax system stable, and thus no major changes are expected following the 2025 election.

In 2020, provisional tax changes were made to stimulate investments in the petroleum sector, due to the Covid 19 pandemic. The main benefit of being subject to the temporary rules is the right to calculate an uplift which is deductible in the special tax basis. This benefit will be in effect for certain investments going forward. Especially Sosialistisk Venstreparti has been clear that they want to further reduce the benefit, and as such, the uplift can be subject to negotiations should the left parties maintain the majority of the Parliament.

Further, across the party’s election manifestos there is seemingly a direction in support for increasing the current CO2 tax, but with different approaches. As an example, Arbeiderpartiet proposes to gradually increase the CO₂ tax within 2030 and to announce an escalation plan after 2030. On the other hand, Fremskrittspartiet maintains that it does not wish to raise the current CO₂ tax, arguing that imposing a higher levy before alternative technologies are in place is not a viable approach. Based on the different views and approaches, debates (and potential changes) to the design of the CO₂ tax are likely to be expected in coming years.

Observations and concluding remarks

The outcome of the upcoming 2025 parliamentary election will shape the political landscape for Norway’s petroleum industry, with various parties proposing different approaches to licensing, parliamentary oversight, taxation, and environmental policy.

While Norway’s political landscape may be said to have become increasingly fragmented since 2021, with traditional coalition arrangements dissolving, the fundamental support for petroleum activities on the NCS remains robust. The combined backing from parties such as Arbeiderpartiet, Fremskrittspartiet, Høyre, and Senterpartiet, who represent about 3/4 of the voter base, provides a substantial and firm foundation for continued petroleum operations on the NCS.

However, this apparent stability masks certain underlying tensions. The polls indicate that support from several of the smaller parties that are generally not positive to petroleum activities will be required on both sides when it comes to securing a majority. As an example, compared to 2021, when the three parties Arbeiderpartiet, Sosialistisk Venstreparti and Senterpartiet had majority together, recent polls suggest that maybe also Rødt and Sosialistisk Venstreparti will be required to achieve a majority if the left side should win the election. Similarly, Venstre, which is expected to be required for the right side to get a majority, have recently presented an ultimatum, and stated that they will push through their climate demands in exchange for their support to a right side government, including that a new government must cut far more greenhouse gases than the current government does.[10]

Depending on the outcome, it is therefore potentially a risk that certain policy shifts may emerge driven by coalition negotiations or smaller parties wanting “wins” in exchange for their parliamentary support, e.g when one or more parties forms a government or ad hoc in the parliamentary period to gain majority for budgets. A clear example of this from the current parliamentary period was when Sosialistisk Venstreparti successfully negotiated the postponement of the 26th licensing round as a condition for supporting the government.

As recent parliamentary votes indicate, the outcomes on certain more specific policy questions remain close, leaving even minor shifts in voter support poised to potentially tip the scales on such matters. The 26th licensing round vote (85-84) and the Melkøya electrification decision (85-84) illustrate that even minor electoral shifts could have an impact on the industry’s operating environment. Similarly, debates or negotiations concerning potential changes to the level of parliamentary oversight could occur, illustrated by the recent debate on Fram Sør and the NOK 15 billion threshold for parliamentary approval of PDOs. While major structural changes to the petroleum tax system appear unlikely, adjustments to CO₂ taxation and investment incentives are topics to watch, particularly if left-leaning parties gain influence.

The intersection of petroleum activities with Norway’s ambitious climate commitments will also likely be an important part of post-election policy discussions. While pro-petroleum parties maintain a substantial majority support, they must increasingly justify continued exploration and development within the framework of international climate obligations in negotiations with parties with opposing views.

This reality underscores the importance of maintaining broad political relationships and preparing for various scenarios. At the same time, this is not new. Compromises and negotiations remain integral to Norway’s parliamentary system, providing smaller parties with an avenue to exert influence on important matters for the petroleum industry.

BAHR will continue monitoring these developments closely and will provide updated analysis as the political situation evolves and coalition negotiations unfold following the election.

[1] The service and supply industries are not included (Source: Norsk Petroleum and the Ministry of Finance)

[2] Source: Data as of 25 August from: pollofpolls.no – Gjennomsnitt av nasjonale målinger med spørsmål om stortingsvalg august 2025

[3] Electoral thresholds are used to prevent too large a spread of the votes for which representatives are elected in parliamentary elections. In Norway, the electoral limit is 4% and a party that falls below the limit will not be able to be allocated additional equalization mandates.

[4] Source: Støre har gitt opp flertall med SV og Sp. Nå har han endret regjeringsplanen.

[5] Source: https://www.tv2.no/nyheter/store-om-rodt/mdg-samarbeid-tar-det-etter-valget/17997378/

Source: Støre åpner for samarbeid med Rødt – Siste nytt – NRK

[6] Source: Listhaug taler til Frps landsstyre – NRK Norge – Oversikt over nyheter fra ulike deler av landet

[7] Original quote in Norwegian: «utvikle, ikke avvikle»

[8] Source: Only available in Norwegian: Voteringsoversikt – stortinget.no

[9] Source: Mot oljenederlag for regjeringen – flertall for å starte arbeidet med ny konsesjonsrunde

Source: Regjeringen sparker i gang omstridt lisensrunde på norsk sokkel | DN

Source: https://www.dn.no/olje/olje-og-gass/barentshavet/terje-aasland/regjeringen-sparker-i-gang-omstridt-lisensrunde-pa-norsk-sokkel/2-1-1854953

[10] Source: Guri Melby: – Hvis ikke Venstre får gjennomslag, får Jonas Gahr Støre fortsette